The digital art landscape has evolved drastically over the past decade, with non-fungible tokens (NFTs) at the forefront of this revolution. In 2025, the NFT ecosystem is no longer just a niche playground for crypto enthusiasts—it has become a thriving marketplace where artists, collectors, and investors converge. Central to this transformation is NFT aggregator marketplace development, a technological advancement that is redefining how digital art is traded, valued, and accessed globally. In this comprehensive exploration, we will unpack how NFT aggregator marketplaces are reshaping the digital art industry, their technological foundations, market implications, and future prospects.

The Evolution of Digital Art and NFTs

Digital art, once confined to the realms of digital illustration, animation, and media-based artworks, has experienced a renaissance thanks to blockchain technology. NFTs, unique digital tokens representing ownership of an asset on the blockchain, allow artists to monetize their creations in unprecedented ways. Unlike traditional art, digital artworks can now be tokenized, verified, and traded with complete transparency and security.

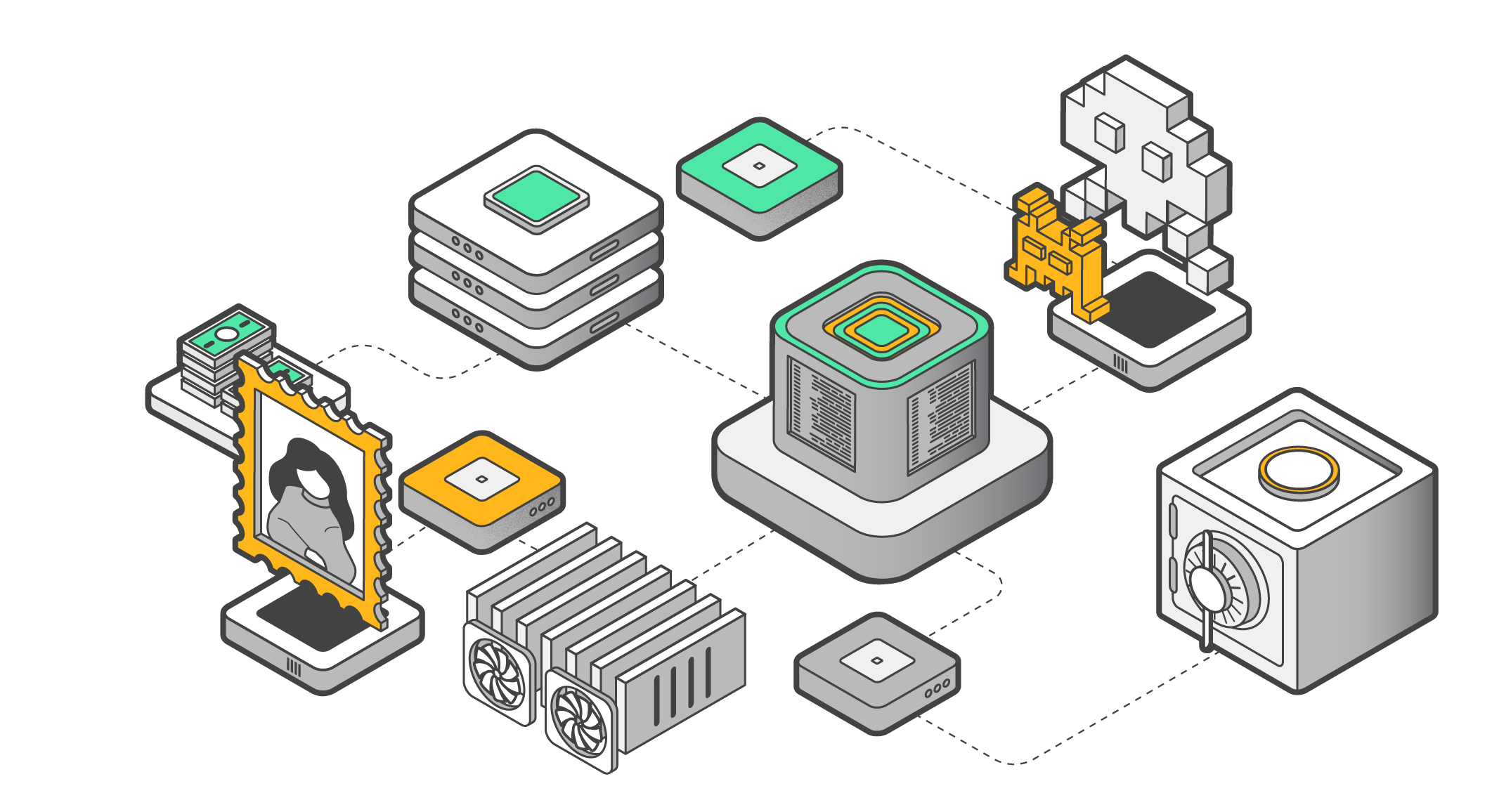

However, the growth of NFTs also brought challenges: fragmented marketplaces, inconsistent pricing, and difficulties for collectors to track or compare assets. Enter NFT aggregator marketplaces, which consolidate data across multiple platforms, providing a unified interface for trading, discovery, and valuation.

Understanding NFT Aggregator Marketplaces

An NFT aggregator marketplace is a platform that collects and consolidates listings from various NFT marketplaces. Instead of navigating multiple platforms to find a specific artwork, users can access all available NFTs through a single, streamlined interface. The key features of these marketplaces include:

-

Cross-Platform Listings: Aggregators fetch data from multiple NFT platforms like OpenSea, Rarible, and Magic Eden, ensuring that users can access a wide variety of digital assets in one place.

-

Price Comparison and Analytics: Aggregator marketplaces provide real-time price tracking, historical data, and analytics, helping collectors make informed decisions.

-

Enhanced Search and Discovery: Advanced filters, recommendation engines, and AI-driven search capabilities allow users to discover artworks that match their interests and investment goals.

-

Liquidity Optimization: By connecting multiple marketplaces, aggregators enhance liquidity, ensuring that sellers can reach a broader audience while buyers have better chances of acquiring desired NFTs.

-

Simplified Transactions: Aggregators often integrate multiple wallets, cryptocurrencies, and payment gateways to streamline purchases, bidding, and trading.

Technological Foundations of NFT Aggregator Marketplaces

The surge in NFT aggregator marketplace development relies heavily on technological innovation. Some of the core technologies driving these platforms include:

1. Blockchain Integration

NFT aggregators leverage blockchain technology to ensure transparency, security, and immutability. Smart contracts play a crucial role in automating transactions and ensuring trust between buyers and sellers without intermediaries.

2. API Connectivity

Aggregator platforms connect to various NFT marketplaces via APIs (Application Programming Interfaces). This enables real-time syncing of listings, prices, and ownership details, creating a seamless user experience.

3. Artificial Intelligence and Machine Learning

AI-powered recommendation engines analyze user preferences, historical purchases, and market trends to suggest artworks. Machine learning algorithms also detect fraudulent listings, ensuring platform integrity.

4. Data Analytics and Visualization

Comprehensive dashboards provide insights into pricing trends, rarity scores, and market movements. This helps both collectors and investors make data-driven decisions, enhancing the strategic value of NFT investments.

5. Cross-Chain Compatibility

With the rise of multiple blockchains supporting NFTs—Ethereum, Solana, Polygon, Tezos—aggregator marketplaces increasingly prioritize cross-chain functionality, allowing users to trade assets across networks seamlessly.

How NFT Aggregator Marketplaces Are Changing Digital Art Trading

NFT aggregator marketplaces are fundamentally altering the dynamics of digital art trading. Here’s how:

1. Enhanced Accessibility for Collectors

Previously, collectors had to monitor multiple marketplaces, each with its own interface, fee structure, and blockchain compatibility. Aggregator marketplaces consolidate this information, making it easier to discover, compare, and acquire NFTs from various sources without switching platforms.

2. Improved Price Transparency

Pricing inconsistencies across different NFT marketplaces often caused confusion for buyers and undervaluation of artworks. Aggregators provide real-time price comparisons, historical transaction data, and rarity insights, ensuring fair pricing and helping prevent speculative bubbles.

3. Increased Exposure for Artists

For artists, listing on multiple marketplaces was often time-consuming and expensive. Aggregators automatically pull listings from various platforms, increasing exposure to a broader audience. This democratizes access to collectors and potentially increases sales opportunities for emerging artists.

4. Liquidity Boost

NFTs historically suffered from low liquidity due to fragmented markets. Aggregator marketplaces consolidate buyers and sellers, enhancing market liquidity. This allows artists and collectors to trade assets more efficiently, increasing overall market activity.

5. Streamlined Investment Decisions

For investors, NFT aggregator marketplaces offer advanced tools for portfolio tracking, market analysis, and trend forecasting. By analyzing sales velocity, price trends, and rarity metrics, investors can make more informed decisions, aligning NFT trading with their financial strategies.

Case Studies of Leading NFT Aggregators in 2025

Several NFT aggregator marketplaces have emerged as key players in 2025, demonstrating the transformative potential of this technology.

1. Gem.xyz

Gem is one of the leading NFT aggregator platforms, enabling users to execute purchases across multiple marketplaces with a single transaction. Its cross-chain compatibility allows collectors to access assets from Ethereum, Solana, and other blockchain networks. Gem’s intuitive interface and advanced analytics make it a preferred choice for serious collectors and investors.

2. NFTrade

NFTrade offers a comprehensive NFT aggregator and marketplace platform, providing users with a full suite of tools including minting, swapping, and trading. Its cross-chain aggregation ensures that digital artists can reach audiences across different ecosystems, maximizing exposure and liquidity.

3. Blur

Blur has emerged as a high-speed NFT aggregator, focusing on active traders and collectors who need real-time market data. Its AI-driven insights and portfolio tracking tools give users an edge in making quick, informed trading decisions.

Benefits for the Digital Art Ecosystem

NFT aggregator marketplaces not only benefit collectors and investors—they are reshaping the entire digital art ecosystem.

1. Market Standardization

Aggregators provide standardized metrics, rarity scores, and valuation tools, reducing market confusion and enhancing transparency. This standardization is critical for institutional investors entering the NFT space.

2. Increased Adoption of Digital Art

By simplifying discovery and trading, aggregators attract new users who were previously hesitant due to market complexity. This expands the overall NFT audience and accelerates mainstream adoption of digital art.

3. Support for Emerging Artists

Aggregator marketplaces often highlight trending artists and rare collections, giving emerging creators a platform to showcase their work without the limitations of a single marketplace.

4. Data-Driven Ecosystem Growth

The wealth of analytics provided by aggregators helps platforms, artists, and collectors make informed decisions. This fosters a more sustainable and strategically guided digital art market.

Challenges in NFT Aggregator Marketplace Development

Despite the growth and benefits, NFT aggregator marketplaces face several challenges:

-

Cross-Chain Integration Complexity: Aggregating NFTs across multiple blockchains requires robust infrastructure and smart contract interoperability.

-

Scalability Issues: High-volume trading can strain aggregator platforms, affecting speed and performance.

-

Regulatory Uncertainty: With increasing global scrutiny of crypto assets, aggregators must navigate complex compliance landscapes.

-

Data Accuracy and Fraud Prevention: Ensuring accurate, real-time listings and preventing fraudulent assets remains a technical and operational challenge.

-

User Experience Balancing: Aggregating diverse marketplaces while maintaining a seamless, intuitive interface is a constant design challenge.

The Future of NFT Aggregator Marketplaces

The trajectory of NFT aggregator marketplaces in 2025 suggests continued innovation and integration:

1. AI-Powered Asset Valuation

Advanced AI models will provide real-time predictive valuations based on rarity, artist reputation, market sentiment, and historical trends. This will transform NFT trading into a more analytics-driven investment.

2. Integration with Metaverse Platforms

As metaverse adoption grows, NFT aggregators will connect digital art with virtual spaces, enabling users to purchase, showcase, and trade artworks directly within immersive environments.

3. Fractional Ownership and DeFi Integration

Future NFT aggregators are likely to facilitate fractional ownership of high-value NFTs, allowing multiple investors to co-own rare digital art. Integration with decentralized finance (DeFi) protocols will also unlock liquidity and lending options.

4. Enhanced Social Trading Features

Social and community-driven features, such as follower feeds, curated collections, and collaborative portfolios, will become integral, creating an interactive and engaging ecosystem for collectors.

5. Global Market Expansion

NFT aggregator marketplaces will continue expanding to emerging markets, bridging the gap between local digital artists and global collectors, thereby democratizing access to digital art worldwide.

Conclusion

NFT aggregator marketplace development is revolutionizing digital art trading in 2025. By consolidating fragmented markets, providing advanced analytics, and enhancing accessibility, these platforms empower artists, collectors, and investors alike. The integration of AI, blockchain, and cross-chain capabilities ensures that NFT trading is transparent, efficient, and strategically informed.

As we move forward, the continued evolution of aggregator marketplaces will not only redefine digital art ownership but also create a more interconnected, liquid, and inclusive ecosystem for creative expression. Artists can reach wider audiences, collectors can make smarter investments, and investors can leverage data-driven insights to maximize returns. The future of digital art trading is not just decentralized—it is aggregated, intelligent, and poised for global growth.

NFT aggregator marketplaces are no longer a supplementary tool—they are the backbone of the digital art economy in 2025, transforming the way we create, trade, and experience art in the blockchain era.