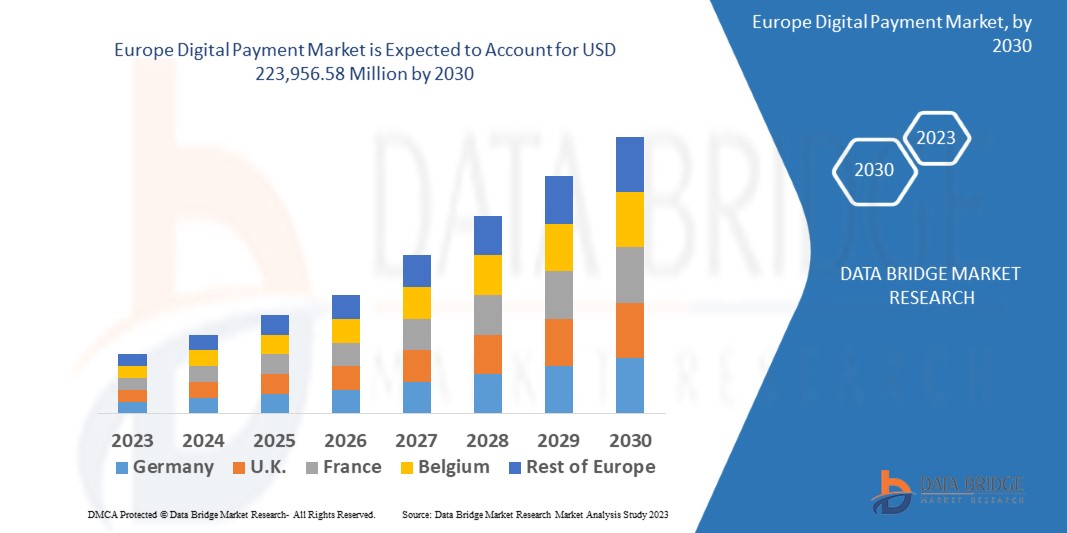

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 223,956.58 million by 2030, which is USD 56,827.44 million in 2022, at a CAGR of 18.70% during the forecast period.

Introduction

The Europe digital payment market has evolved rapidly over the past decade as consumers, merchants, and financial institutions embrace digital channels for financial transactions. Driven by widespread smartphone penetration, robust internet infrastructure, supportive regulatory frameworks, and growing consumer preference for convenience and contactless payments, the region continues to transform how money moves. Digital payments encompass a broad set of methods including mobile wallets, contactless cards, account-to-account transfers, QR-based systems, and buy-now-pay-later solutions. Innovation, coupled with policy support, has encouraged diverse market entrants ranging from incumbent banks to fintech startups.

Market Overview

Europe is home to a diverse payments landscape that includes advanced economies with mature digital ecosystems and developing markets where adoption is accelerating. Payment service providers, banks, fintech startups, and technology firms compete to offer secure, seamless, and interoperable solutions. Interbank initiatives, open banking standards, and pan-European payment schemes have contributed to interoperability, competition, and innovation. At the same time, merchants across retail, travel, utilities, and digital commerce segments seek integrated checkout experiences that reduce friction and support omnichannel customer journeys. The result is a layered ecosystem where front-end user interfaces connect to back-end rails and settlement networks through APIs and standardized protocols.

Key Market Drivers

The shift toward cashless transactions is a central driver in Europe. Consumers increasingly favor contactless and remote payment options for speed and hygiene. Regulatory initiatives such as payment services directives and open banking requirements have enabled greater competition and innovation while improving consumer protection. Rapid adoption of smartphones and wearable devices has facilitated mobile wallet usage, while investments in payment infrastructure, including instant payments and QR-based acceptance, have broadened access. E-commerce growth and an appetite for faster disbursements in B2B contexts further propel demand for reliable digital rails.

Technology and Innovation

Technological innovation fuels the digital payments landscape. Tokenization, biometric authentication, and secure element technologies improve payment security and user experience. APIs and open banking frameworks allow third-party providers to build services that integrate with bank accounts, enabling new value-added offerings like account aggregation, automated reconciliation, and personalized finance management. Blockchain and distributed ledger technologies are being explored for cross-border settlement and enhanced transparency, while edge computing and 5G deployment promise lower latency for mobile and in-store payments. Vendors also invest in unified SDKs for merchants to accelerate integration and maintain consistent UX across platforms.

Payment Methods and Use Cases

Contactless card payments remain widespread, supported by major card networks and issuers. Mobile wallets and app-based payments have gained traction among younger consumers and in urban centers, enabling tap-to-pay at point of sale and in-app purchases. Account-to-account instant payments have become important for peer-to-peer transfers, bill payments, and merchant settlements, providing real-time confirmation and settlement. E-commerce continues to drive demand for secure online checkout experiences, with one-click purchases, digital wallets, and payment orchestration platforms helping merchants route transactions to the most cost-effective or reliable providers.

Regulatory Environment

Europe’s regulatory environment is a significant enabler of digital payment growth. Regulations focus on security, consumer rights, transparency, and competition. Payment directives have set standards for payment service providers, third-party access, and fraud mitigation measures. Data protection laws ensure consumer privacy while authentication mandates require strong customer authentication for many digital transactions. Regulatory sandboxes and collaboration between authorities and industry help test new models, balancing innovation with consumer protection. Supervision and cross-border cooperation among regulators further support harmonized approaches across jurisdictions.

Security and Fraud Prevention

As digital payments expand, security concerns remain paramount. Payment actors deploy multi-layered defenses including encryption, tokenization, device binding, and adaptive authentication. Machine learning models analyze transaction patterns to detect anomalies and block fraudulent activity in real time. Collaborations across banks, processors, and fintech firms facilitate information sharing about fraud trends and coordinated responses. Consumer education about phishing, account security, and safe payment behavior is also central to reducing fraud vectors and maintaining trust in digital channels.

Merchant Acceptance and Infrastructure

Merchant acceptance infrastructure has modernized with widespread POS terminals supporting contactless NFC and mobile wallet payments. E-commerce merchants adopt payment gateways, hosted checkouts, and fraud screening services to manage online transactions. Small and medium enterprises benefit from payment service providers offering simplified onboarding, integrated point-of-sale solutions, and mobile acceptance. Investments in offline-capable acceptance and lightweight QR solutions expand acceptance in markets where connectivity may be intermittent, while payment orchestration platforms enable merchants to optimize routing, reconciliation, and failover across multiple acquirers and processors.

Cross-Border and International Payments

Cross-border payments in Europe involve a mix of euro-denominated transactions within the euro area and currency conversions for transactions involving other currencies. Initiatives to simplify cross-border payments, reduce costs, and accelerate settlement have gained attention. Instant cross-border solutions and pan-European schemes aim to provide faster clearance and more transparent fees for consumer and corporate users. Fintechs and payment processors are innovating to streamline currency conversion, improve quote transparency at checkout, and automate compliance for cross-border merchant onboarding.

Banking and Fintech Collaboration

Collaboration between incumbent banks and nimble fintech firms drives many innovations. Banks offer APIs and platforms that fintechs can leverage to deliver consumer-facing features, while fintechs provide user experience design, onboarding, and niche payment services. Strategic partnerships, white-label solutions, and acquisition activity are common as financial institutions seek to enhance their digital capabilities while complying with regulatory standards. Joint ventures and co-creation labs allow rapid prototyping of services such as embedded payments or merchant financing.

Infrastructure Investment and Sustainability

Infrastructure investments focus on resilient, scalable payment processing, cloud-native architectures, and real-time settlement capabilities. Sustainability considerations are increasingly important, with payment providers assessing energy consumption, electronic waste, and carbon footprint of data centers. Green fintech initiatives aim to create sustainable payment rails and encourage environmentally responsible consumer behavior through incentives and reporting tools. As data centers and networks decarbonize, payment ecosystems benefit from cleaner operating models.

Consumer Behavior and Adoption

Consumer preferences influence product features and payment experiences. Convenience, speed, and perceived security are the top priorities. Younger consumers tend to adopt mobile wallets and in-app payments more readily, while older demographics may prefer bank transfers or card-based solutions. Trust in providers, seamless onboarding, and transparent fee structures are critical to drive adoption across all age groups. Social commerce and embedded payments through messaging apps and platforms are expanding payment touchpoints, shaping expectations for frictionless checkout.

Challenges

Despite strong momentum, the Europe digital payment market faces challenges. Fragmentation across national systems, local preferences, and varied regulatory nuances can complicate pan-European expansion. Legacy infrastructure in some banks and merchants slows integration and migration to modern APIs. Interoperability between diverse payment methods and cross-border harmonization remain areas requiring coordinated efforts. Privacy concerns and evolving cyber threats demand ongoing investments in security and compliance. Merchant margin pressure and competition also challenge sustainable pricing models.

Opportunities

Opportunities abound for innovation and growth. Expansion of instant payment rails and the integration of value-added services such as loyalty, finance management, and point-of-sale financing create new customer propositions. Cross-border e-commerce, tourism recovery, and corporate treasury optimization present demand for efficient payment solutions. Emerging technologies like central bank digital currencies will open fresh avenues for experiments in retail and wholesale payments, while merchant acceptance innovations expand reach into previously underserved micro-merchants and physical markets.

Competitive Landscape

The competitive landscape includes banks, card networks, payment processors, fintech startups, and technology firms. Established players focus on scale, reliability, and regulatory compliance, while challengers emphasize user experience, niche propositions, and rapid innovation cycles. Collaborations, acquisitions, and strategic alliances shape the market, enabling broader service offerings and geographic reach. Payment orchestration, embedded finance platforms, and vertical-specific payment propositions are key differentiators for market entrants.

Innovation in SME and Embedded Finance

An important subtrend is the rise of small and medium enterprise-focused payment ecosystems that bundle payment acceptance, lending, and accounting into single platforms. These integrated solutions simplify cash flow management, enable faster reconciliations, and reduce administrative burden for merchants. Embedded finance is enabling non-financial platforms to offer payment services, loyalty programs, and microcredit within their user journeys, creating new distribution channels. Real-time analytics and predictive scoring capabilities allow providers to offer tailored credit and insurance at checkout. Collaboration with regulators to implement proportionate KYC and AML frameworks can accelerate onboarding while managing risk. Fragmentation across payment rails is gradually addressed by standardization initiatives and industry consortia promoting common APIs, message formats, and settlement practices. Education campaigns targeting older consumers and SMEs can broaden adoption and foster greater financial inclusion and resilience too.

Future Outlook

The future of digital payments in Europe will be shaped by interoperability, security, and user-centric innovation. Continued convergence of banking services with payment capabilities will streamline the customer journey. The push for real-time settlement, cross-border efficiency, and holistic payment ecosystems suggests sustained transformation. As digital payments become more embedded across daily activities, the emphasis on inclusivity, affordability, and trust will define long-term adoption. Technological advances, regulatory dialogue, and collaboration among banks, fintechs, and merchants will determine the pace and quality of adoption.

Conclusion

The Europe digital payment market is a dynamic ecosystem balancing innovation, regulation, and consumer demand. Achieving seamless, secure, and accessible payment experiences across a diverse set of countries requires continued collaboration among stakeholders. With ongoing technological advances and supportive policy frameworks, Europe is poised to deliver convenient and resilient digital payment solutions for consumers and businesses while addressing fragmentation, security, and inclusion challenges.

FAQs

What are the main drivers of digital payment adoption in Europe?

How do regulatory frameworks influence payment innovation in Europe?

What are the primary security measures used to protect digital payments?

Which payment methods are gaining the most traction among European consumers?

What challenges do cross-border digital payments face in the region?

Equip yourself with actionable insights and trends from our complete Europe Digital Payment Market analysis. Download now:https://www.databridgemarketresearch.com/reports/europe-digital-payment-market

Browse More Reports:

Global Deferasirox Market

Global Dehydrated Alfalfa Market

Global Density Meter Market

Global Dental Syringes Market

Global Diabetic Retinopathy Market

Global Diamond Mining Market

Global Diesel Engine Catalyst Market

Global Dietary Supplements Packaging Market

Global Diols and Polyhydric Alcohols Market

Global DIP Microcontroller Socket Market

Global Direct Lateral Interbody Fusion (DLIF) and eXtreme Lateral Interbody Fusion (XLIF) Implants Market

Global Disposable Charcoal Activated Filter Face Masks Market

Global Disposable Insulin Pumps Market

Global Disruptive Behavior Disorder Treatment Market

Global Distributed Denial of Service Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 976

Email:- [email protected]