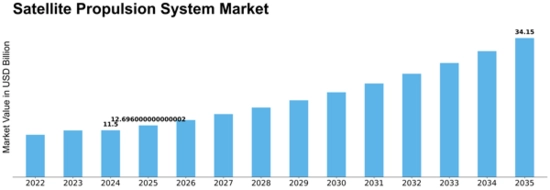

The Satellite Propulsion System Market is entering a robust phase of expansion, supported by spiralling demand for satellite launches and evolution of propulsion technologies. According to recent research by Market Research Future, the market was valued at around US$11.5 billion in 2024, and is projected to climb to approximately US$34.15 billion by 2035, representing a compound annual growth rate (CAGR) of about 10.4% through the next decade.

Industry Overview

In recent years, the aerospace sector has seen a marked shift towards more capable, longer-life satellites, constellation deployments, and miniaturised platforms. These trends heighten the need for advanced propulsion systems, which serve two broad functions: boosting satellites to their intended orbit or orbit-raising and manoeuvring during operations. The propulsion sub-industry lies at the intersection of space hardware manufacturing, mission services and launch operations.

Key Players’ Role

A few companies dominate the competitive landscape. For instance, Aerojet Rocketdyne (US) continues to push innovations in electric propulsion systems. Meanwhile, Northrop Grumman (US) is deepening its capabilities through strategic acquisitions in propulsion-technology firms. In Europe, Airbus Defence and Space (UK/France) is embracing sustainable propulsion solutions. These firms are not only shaping supply but also influencing standards, system integration practices and aftermarket services.

Segmentation and Growth Trends

Breaking down by propulsion-type, the “cold gas” segment remains the largest, due to its reliability and relatively simple architecture for orbit-maintenance applications.Concurrently, “green liquid” propulsion (non-toxic propellant systems) is registering the fastest growth, driven by increasing emphasis on sustainability in space missions. Geographically, North America leads with nearly 45 % share, while Asia-Pacific is the fastest emerging region, thanks to growing space programmes in India, Japan and elsewhere.

Market Outlook

Going forward, several factors are expected to sustain growth: the proliferation of small-satellite constellations, increased launches for communications or earth-observation missions, government and commercial funding, and the drive toward propulsion systems that are lighter, greener and more efficient. The market is likely to shift from purely cost-based competition to one grounded in technology differentiation, system reliability and environmental credentials. Firms that invest early in propulsion innovations—especially for small-sat platforms—will likely capture higher share and yield stronger returns.

In Conclusion

For stakeholders across the value chain—from propulsion-component suppliers and satellite OEMs to launch providers and service fleets—the satellite propulsion space presents compelling opportunity. With an approximate CAGR of 10 % and a forecast tripling of market size by 2035, the stage is set for significant growth and transformation in how satellites manoeuvre, stay on-orbit and deliver services.

Exploring the Growth Orbit: Key Trends in the Satellite Propulsion System Market