Global Material Handling Robotics Market: Industry Analysis and Forecast (2025–2032)

Market Overview

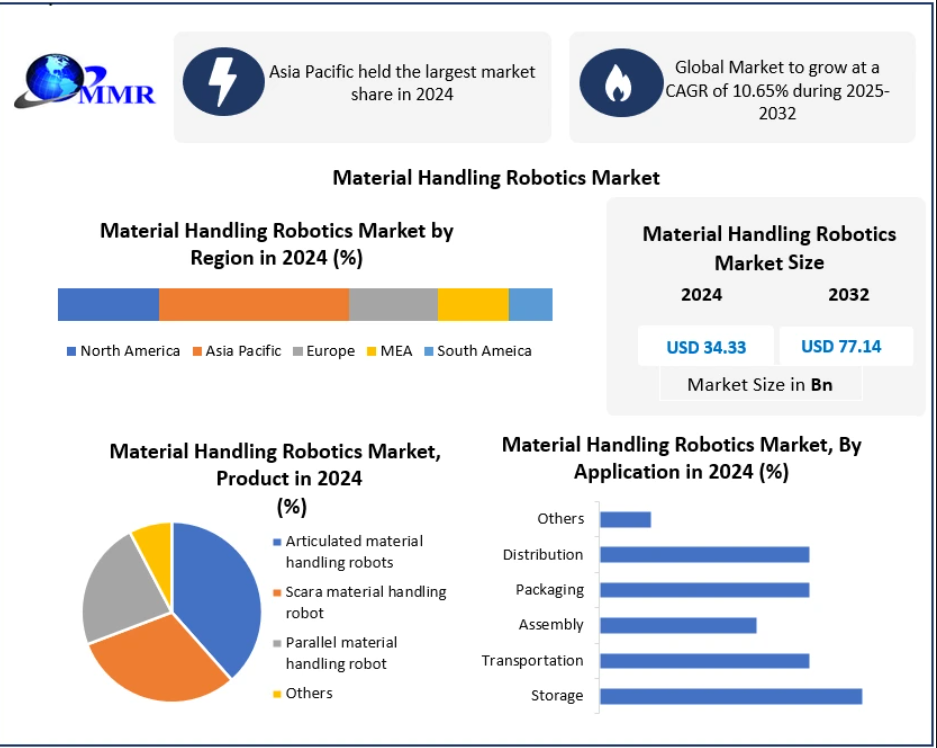

The Global Material Handling Robotics Market was valued at USD 34.33 billion in 2024, and it is projected to reach USD 77.14 billion by 2032, growing at a CAGR of 10.65% during the forecast period (2025–2032).

Material handling robots are increasingly deployed in manufacturing facilities to automate repetitive, hazardous, and physically demanding tasks. These robots perform operations such as palletizing, depalletizing, pick-and-place, and packaging, enhancing manufacturing efficiency, flexibility, and consistency. The adoption of these systems not only minimizes ergonomic risks but also promotes lean management practices across production environments.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/66485/

Market Definition

Material handling robotics refers to robotic systems used for moving, storing, controlling, and protecting materials during manufacturing, warehousing, and distribution. These robots streamline production lines, reduce human error, and improve throughput and product quality. They play a key role in industries that prioritize automation to boost efficiency and workplace safety.

Market Dynamics

Drivers

-

Rising Manufacturing Automation: Increasing investment in smart factories and the need to reduce human intervention in repetitive processes are major drivers of market growth.

-

Enhanced Operational Efficiency: Material handling robots improve accuracy and speed in manufacturing, resulting in faster delivery times and higher customer satisfaction.

-

Workplace Safety: Robots minimize risks associated with manual material handling, helping companies comply with strict workplace safety regulations.

Restraints

-

High Initial Investment: The upfront cost of installing material handling robots and automation systems remains a significant barrier for small and medium-sized enterprises.

-

Skilled Workforce Requirement: Maintenance, programming, and system integration require specialized technical skills, creating workforce challenges for some manufacturers.

Opportunities

-

Growing E-Commerce and Logistics Sector: The rise in automated warehousing, particularly in the e-commerce industry, is fueling demand for robotic material handling solutions.

-

Integration with AI and IoT: The combination of robotics with AI, machine vision, and IoT is enabling smarter, self-learning systems that can optimize workflows autonomously.

Segment Analysis

By Product

-

Articulated Material Handling Robots

-

SCARA Material Handling Robots

-

Parallel Material Handling Robots

-

Others

The articulated robots segment dominated the market in 2024 and is expected to continue leading during the forecast period. Their high flexibility, wide range of motion, and ability to perform complex, heavy-duty tasks make them ideal for various manufacturing applications.

By Application

-

Storage

-

Transportation

-

Assembly

-

Packaging

-

Distribution

-

Others

The storage segment accounted for the largest share in 2024 and is projected to maintain its dominance through 2032. The increasing adoption of automated warehouses in e-commerce and logistics sectors is driving significant demand for robotic storage solutions.

By End-Use Industry

-

Automotive

-

Electrical & Electronics

-

Metal & Machinery

-

Chemical

-

Food & Beverage

-

Others

The automotive industry remains the leading end-user segment, driven by the widespread use of robots for part handling, assembly, and packaging. The need for precision, consistency, and productivity in automotive manufacturing continues to boost market growth.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/66485/

Regional Insights

The Asia-Pacific region dominated the global market in 2024 and is expected to maintain its leadership through the forecast period. This dominance is attributed to:

-

The presence of major players such as FANUC, Yaskawa, and Kawasaki Robotics

-

Rapid industrialization in China, Japan, South Korea, and Southeast Asia

-

Expanding e-commerce and logistics infrastructure

-

Rising adoption of advanced technologies such as IoT, AI, and big data analytics for manufacturing optimization

China, in particular, stands out as a key contributor due to significant investments in manufacturing automation and warehousing. Additionally, low labor costs and improved transportation networks in Asia Pacific further support regional growth.

Competitive Landscape

The global material handling robotics market is highly competitive, with several established players focusing on innovation, partnerships, and automation technology advancement. Key players include:

-

ABB Pte Ltd.

-

Adept Technology Inc.

-

Machinery Automation & Robotics Pty Ltd.

-

Daihen Engineering Co. Ltd.

-

Denso Wave Inc.

-

Epson America, Inc.

-

Staubli International AG

-

FANUC Corporation

-

KUKA Robotics Corporation

-

Kawasaki Robotics Inc.

-

Nachi Robotic Systems Inc.

-

Toshiba Machine Corp.

-

Yaskawa Motoman Robotics

-

Apex Automation and Robotics

-

Mitsubishi Electric Corp.

-

Rockwell Automation Inc.

-

Reis Robotics

-

STEP Electric Corporation

-

Hyundai Robotics

These companies are actively engaged in product development, collaborations, and regional expansion to strengthen their market presence.

Key Takeaways

-

Market Size (2024): USD 34.33 Billion

-

Market Size (2032): USD 77.14 Billion

-

CAGR (2025–2032): 10.65%

-

Leading Segment: Articulated Robots

-

Top End-User: Automotive Industry

-

Dominant Region: Asia-Pacific

Conclusion

The Material Handling Robotics Market is poised for strong growth through 2032, driven by the increasing adoption of automation, rising industrial productivity demands, and expanding e-commerce operations worldwide. As robotics technology continues to evolve through advancements in AI, IoT, and machine vision, manufacturers across industries are expected to invest heavily in automated material handling systems to enhance competitiveness, safety, and efficiency.