Global Air Powered Vehicle Market Size, Share, and Forecast (2025–2032)

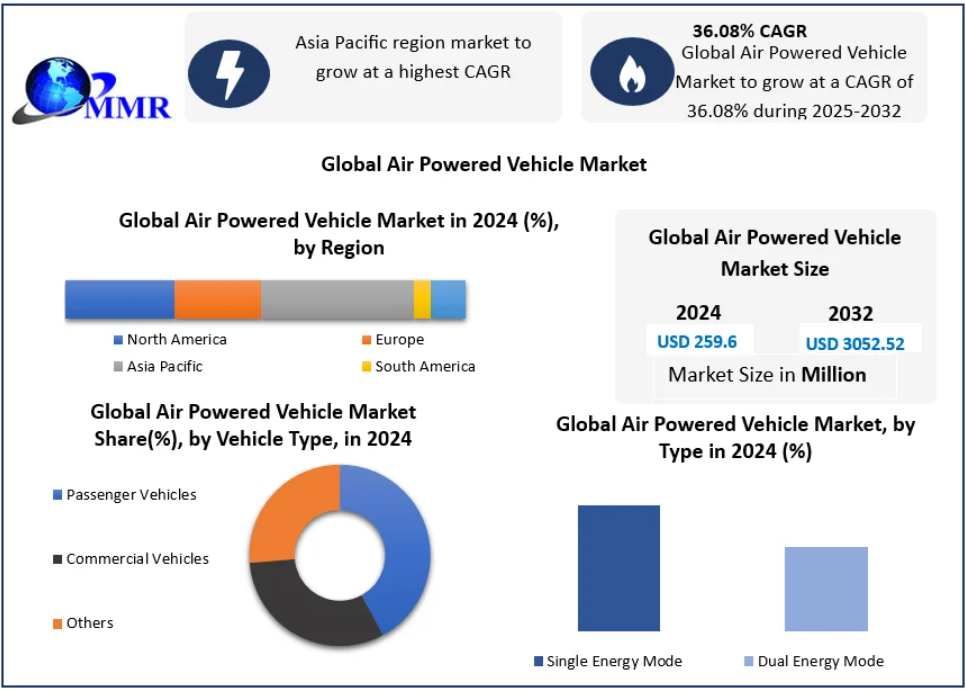

The Global Air Powered Vehicle Market was valued at USD 259.6 million in 2024 and is projected to reach USD 3,052.52 million by 2032, expanding at an exceptional CAGR of 36.08% during the forecast period (2025–2032).

Global Air Powered Vehicle Market Overview

Air powered vehicles (APVs) utilize compressed air as the main propulsion source, offering a clean, sustainable, and cost-effective transportation alternative. These vehicles operate without traditional fuels, producing zero tailpipe emissions, making them ideal for urban mobility, municipal fleets, and lightweight delivery applications.

The market’s rapid growth is primarily fueled by rising environmental concerns, government-backed sustainability policies, and technological advances in air compression systems and lightweight materials.

In 2024, the Asia Pacific region dominated the market, accounting for over 55% of global demand, driven by robust adoption in China, India, and Japan. Urban mobility and delivery applications represented nearly 65% of total air-powered vehicle sales in the region, highlighting the segment’s growing relevance for clean last-mile logistics and urban fleet operations.

Major innovators such as Tata Motors, Motor Development International (MDI), and Honda Motor Co. are spearheading development, from urban concept cars to advanced air compression technologies, pushing air propulsion closer to commercial viability.

To identify the key high-growth segments, request your complimentary sample report by clicking here:https://www.maximizemarketresearch.com/request-sample/18309/

Global Air Powered Vehicle Market Dynamics

Key Growth Drivers

-

Technological Advancements

Significant progress in air compression efficiency, energy recovery systems, and lightweight materials is improving the performance and affordability of air powered vehicles. Startups like Zero Pollution Motors are pioneering breakthroughs that enhance range and lower costs, making compressed-air propulsion increasingly practical. -

Sustainability and Clean Mobility Trends

With growing awareness about climate change and air quality, air powered vehicles offer a zero-emission alternative to traditional internal combustion vehicles. Similar to the consumer acceptance of EVs, particularly models like the Tesla Model 3, the rise of APVs reflects a shift toward cleaner mobility options. -

Government Policies and Incentives

Governments worldwide are introducing tax incentives, subsidies, and R&D grants for zero-emission vehicles. As electric vehicle policies mature, similar frameworks are expected to emerge for air powered vehicles, encouraging large-scale adoption once commercial deployment accelerates. -

Urbanization and Congestion Challenges

Increasing urban density and the need for low-maintenance, compact transportation solutions have made air powered vehicles ideal for city commuting, last-mile delivery, and municipal services. Their simplicity and low running costs position them as attractive options for smart city mobility programs.

Market Challenges

Despite their potential, the air powered vehicle market faces several technical and infrastructural barriers:

-

Limited Refueling Infrastructure – The absence of widespread air refueling networks restricts adoption, echoing the early challenges faced by electric vehicles before the expansion of charging infrastructure.

-

Range Limitations – Compressed air has lower energy density compared to gasoline or batteries, resulting in shorter travel ranges. This limitation restricts APVs primarily to urban applications.

-

Performance and Weight Concerns – Larger storage tanks needed for compressed air increase vehicle weight and complexity, affecting design efficiency.

-

Consumer Perception – Market acceptance is still evolving, with many consumers perceiving APVs as less powerful or less practical compared to electric vehicles.

Addressing these challenges through continued innovation, partnerships, and policy support will be crucial for the widespread commercialization of air-powered technologies.

Global Air Powered Vehicle Market Segment Analysis

By Energy Mode

-

Single Energy Mode

Vehicles operating exclusively on compressed air are ideal for short-distance, low-speed applications such as urban commuting and small cargo transport. Their simplicity, low operating cost, and zero-emission nature make them attractive for eco-conscious consumers and local governments. -

Dual Energy Mode

Dual-mode air powered vehicles combine compressed air propulsion with electric or gasoline backup systems, extending range and improving flexibility. This hybrid approach allows for urban and highway driving while maintaining environmental benefits. Although slightly more complex, dual energy systems are gaining traction among users requiring longer range and higher performance.

Regional Insights

Asia Pacific – Market Leader

The Asia Pacific region remains the global leader, accounting for the majority of air powered vehicle demand. Factors such as rapid urbanization, congestion in megacities, and strong government emphasis on clean mobility are fueling adoption.

Countries like India, China, and Japan are at the forefront, with local manufacturers (e.g., Tata Motors and Mahindra & Mahindra) investing in R&D and pilot programs for urban fleets and shared mobility systems.

Europe

Europe’s commitment to carbon neutrality and innovative vehicle technologies supports a growing ecosystem for air powered vehicles. European companies such as MDI (France), Renault, and Volkswagen AG are exploring hybrid air-electric platforms and lightweight designs suited for compact city cars.

North America

North America demonstrates growing interest in alternative propulsion systems, led by innovators like Zero Pollution Motors and Wrightspeed Inc. Favorable state-level clean mobility initiatives, particularly in the U.S. and Canada, are expected to open niche opportunities in logistics and short-range applications.

South America and Middle East & Africa

While awareness of green mobility is rising, these regions face economic and infrastructural constraints that limit the widespread adoption of APVs. Nonetheless, as sustainability goals evolve, pilot programs for municipal and industrial applications are expected to emerge.

To identify the key high-growth segments, request your complimentary sample report by clicking here:https://www.maximizemarketresearch.com/request-sample/18309/

Competitive Landscape

The global air powered vehicle market is highly fragmented and innovation-driven, with a mix of established automakers and emerging startups. Key players include:

Asia Pacific

-

Tata Motors (India)

-

Mahindra & Mahindra (India)

-

Honda Motor Co., Ltd. (Japan)

-

Toyota Motor Corporation (Japan)

-

Hyundai Motor Company (South Korea)

Europe

-

Motor Development International (MDI, France)

-

Renault (France)

-

Volkswagen AG (Germany)

-

BMW Group (Germany)

-

Daimler AG (Germany)

North America

-

General Motors (U.S.)

-

Ford Motor Company (U.S.)

-

Proterra Inc. (U.S.)

-

Wrightspeed Inc. (U.S.)

-

Zero Pollution Motors (U.S.)

These companies are emphasizing energy efficiency, hybrid air-electric systems, lightweight materials, and urban fleet integration to enhance performance and make APVs commercially viable.

Key Market Trends

-

Growing Green Urban Mobility Adoption:

Cities are embracing air powered vehicles for zero-emission transport in taxis, delivery fleets, and public services, particularly in Asia Pacific. -

Advancement in Hybrid Air-Electric Models:

Automakers are developing hybrid air-electric propulsion systems to overcome range limitations and broaden use cases. -

Development of Lightweight High-Pressure Tanks:

Advances in composite material tanks (up to 450 bar) are improving air storage efficiency and expanding operational range for commercial applications.

Recent Developments

| Date | Company | Development |

|---|---|---|

| Jan 16, 2025 | Tata Motors & MDI | Signed a partnership to advance compressed-air engine technology in India, focusing on scalability and commercialization. |

| Sep 23, 2024 | MDI (France) | Rebranded its air vehicle range under the FlowAIR series, introducing models like OneFlowAIR, MiniFlowAIR, CityFlowAIR, MultiFlowAIR, and AirPod. |

| Jan 31, 2024 | Tata Motors | Showcased air propulsion prototypes at the Bharat Mobility Global Expo 2024, reinforcing its multi-fuel, zero-emission vision. |

Global Air Powered Vehicle Market Report Scope

| Report Coverage | Details |

|---|---|

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Market Size (2024) | USD 259.6 Million |

| Market Size (2032) | USD 3,052.52 Million |

| CAGR (2025–2032) | 36.08% |

| Segments Covered | Energy Mode (Single, Dual), Vehicle Type (Passenger, Commercial, Others) |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East & Africa |

Conclusion

The Global Air Powered Vehicle Market is entering an exciting growth phase, driven by sustainability trends, rapid technological progress, and rising urban mobility needs. Although challenges such as range limitations and refueling infrastructure remain, continued innovation in hybrid propulsion, lightweight materials, and government policy support is expected to transform air powered vehicles from experimental concepts into practical, eco-efficient mobility solutions by 2032.