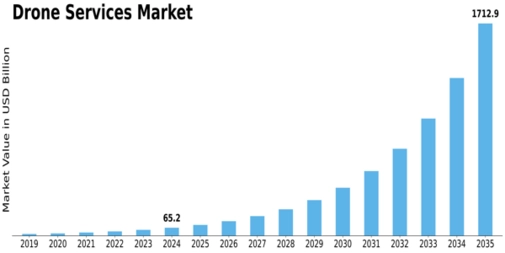

The rapid evolution of technology and business needs has thrust the drone services market into a major growth phase. According to MRFR, the market is projected to hit USD 65.18 Billion by 2032, at a strong CAGR of 34.6% from 2024-2032.

We’ll explore market size, share, growth, trends, forecast, industry challenges, and key players in this analysis.

Understanding Size & Share

Drone Services market value — USD 65.18 billion by 2032 per MRFR. Share refers to how that value will be distributed across players, geographies, segments and service types. The analysis indicates that service-oriented providers (versus pure hardware vendors) will claim increasing share as the industry matures.

Growth is powered by multiple sectors adopting drone services at scale.

Key Growth Trends

-

Drone services are increasingly used in applications such as mapping & surveying, data acquisition & analytics, inspection & monitoring, environmental monitoring, search & rescue. The report’s segmentation illustrates this.

-

Technological innovation (AI, sensors, analytics), regulatory advances, and increasing willingness of industries to outsource drone operations drive growth.

-

Post-COVID acceleration: Use of drones for deliveries, remote monitoring and logistics grew faster during the pandemic and has established new service models.

Market Forecast & Industry Outlook

The forecast period of 2024-2032 gives a clear time-horizon. A CAGR of 34.6% for that period shows explosive growth potential. The industry outlook is positive: services will shift to become more automated, data-driven and integrated with other digital systems.

From a strategic perspective, this presents an opportunity for new entrants and incumbents alike to capture growth, particularly in sectors like agriculture, infrastructure, logistics and utilities.

Key Players & Competitive Keywords

In this competitive industry, some of the established names include:

-

Measure (US)

-

Precision Hawk (US)

-

Terra Drone Corporation (Japan)

-

CYBERHAWK Innovations Limited (UK)

-

DroneDeploy (US)

-

DJI (China)

In competitor keywords, service providers need to compare themselves not only against other drone companies, but also against data analytics firms, cloud service firms, and end-industry integrators.

Challenges & Strategic Considerations

The analysis also identifies key hurdles: safety concerns, lack of risk management frameworks, regulatory uncertainties, operational constraints — all of which can hamper growth if not addressed.

Service providers must design business models that mitigate such risks, invest in compliance, and build strong value propositions that include data insights, service reliability and safety assurances.

Final Take

In sum, the drone market is at a critical inflection point — substantial size, high growth, strong trends, and a defined forecast horizon. Companies that understand the market dynamics, invest in services and analytics, and differentiate with high-value offerings will succeed in this evolving industry.