The Aerospace Parts Manufacturing Market is diversified not only by material and application but also by end-use—specifically original equipment manufacturing (OEM) and aftermarket services. Understanding this segmentation enhances market share and growth analysis for the forecast period.

Market Size & End-Use Breakdown

According to MRFR, the Aerospace Parts Manufacturing Market segment is by end-use into Original Equipment Manufacturer and Aftermarket. While new aircraft production drives the OEM segment, maintenance, repair, overhaul (MRO) and aftermarket parts contribute significantly to the broader manufacturing parts industry. Growth in global air travel, fleet size and aging aircraft boosts demand for both new parts and aftermarket components.

Growth Trends & Industry Analysis

The OEM side of the Aerospace Parts Manufacturing Market is driven by new aircraft orders, rising demand for fuel efficiency, and flight-fleet expansion, especially in commercial aviation. The aftermarket segment experiences growth through increased aircraft utilization, older fleet servicing and component replacement cycles. These dual channels impact market size, share dynamics and volatility in growth rates.

Application & Material Interplay

Within the Aerospace Parts Manufacturing Market, parts manufactured for the OEM segment may include structural components, engine components, electrical components or interior components. For the aftermarket, manufacturing may focus on replacement parts, upgrades, retrofits and component services. The materials used (aluminum, titanium, composites, steel) also influence cost, lead time and performance, and thereby the competitiveness of OEM vs aftermarket manufacturing.

Key Players & Competitive Keywords

In the OEM portion of the Aerospace Parts Manufacturing Market, companies such as Boeing, Airbus, Lockheed Martin and General Electric dominate by supplying original aircraft parts. In the aftermarket space, firms such as Honeywell, Raytheon Technologies and MTU Aero Engines focus on servicing, parts replacement, and upgrades. Competitive keywords relevant here include “aerospace parts OEM manufacturing market,” “aircraft aftermarket parts manufacturing industry,” “OEM aerospace component manufacturing growth trends,” and “aftermarket aerospace parts manufacturing share analysis.”

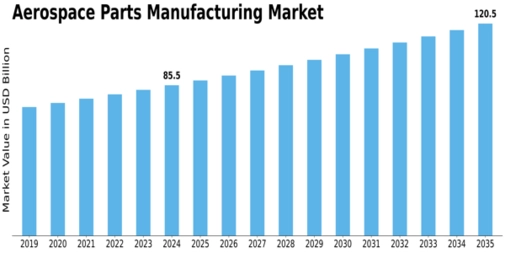

Forecast & Strategic Implication

The forecast period (2025-2035) for the Aerospace Parts Manufacturing Market indicates a combined growth path inclusive of OEM and aftermarket segments. As aircraft fleets age, after-sales demand will rise, supporting aftermarket manufacturing growth. At the same time, new aircraft deliveries and technology shifts (electric/hybrid aircraft, UAVs) will support OEM manufacturing. Companies that build capabilities across both segments will better position themselves in the industry.

Final Thoughts

The Aerospace Parts Manufacturing Market presents a two-pronged opportunity: manufacturing original equipment for new builds and manufacturing parts for the aftermarket repair/upgrade ecosystem. Both channels are essential for full-spectrum market coverage and for optimizing growth, share and industry position through the forecast period. Understanding these end-use dynamics is key for strategic decision-making.