Automotive Market in the UK: Trends, Dynamics, and Future Outlook

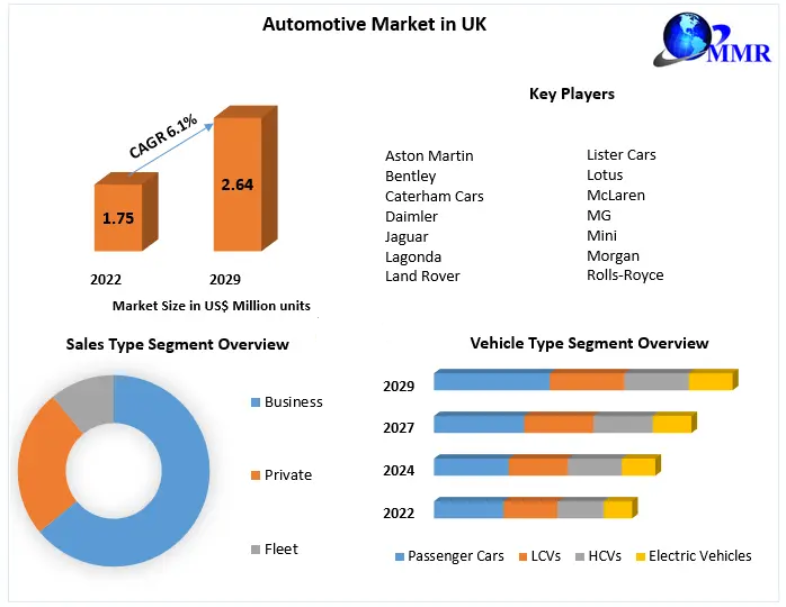

The Automotive Market in the UK has been a cornerstone of the nation’s industrial and economic landscape, contributing significantly to employment, exports, and technological advancement. In 2022, the UK automotive market accounted for 1.75 million units, and it is projected to grow at a CAGR of 6.1% over the forecast period from 2023 to 2029, reaching an estimated 2.64 million units by 2029.

Market Overview

The UK automotive sector has faced unprecedented challenges over recent years, primarily due to COVID-19 disruptions and the ramifications of BREXIT. Supply chain dependencies on EU partners have highlighted vulnerabilities, impacting both manufacturing and distribution. Cash flow pressures and sustainability mandates have further stressed the sector, while declining consumer confidence has affected new car sales.

To mitigate these challenges, dealerships are increasingly adopting digital-first strategies, including virtual purchasing experiences. This digital transformation is reshaping the market, with new entrants leveraging technology to disrupt traditional business models.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/86645/

Market Dynamics

Government Initiatives & Sustainability

The UK government has set ambitious Net Zero targets, positioning the automotive industry as a key driver of this transition. A critical step is the phase-out of Internal Combustion Engine (ICE) vehicles, with a passenger car end-of-sale date set for 2030.

Despite progress, challenges remain. While zero-emission vehicle costs are decreasing, the pace is insufficient to meet 2030 targets while maintaining production volume and global competitiveness. Investment in battery manufacturing, charging infrastructure, and sustainable energy is lagging compared to nations like Germany, the United States, and France. For instance, the UK is projected to have only 12 GWh of lithium-ion battery capacity by 2025, far below Germany's 164 GWh.

Economic Impact & Exports

The automotive industry contributes approximately £15 billion in GVA to the UK economy, with most value created outside the South East. The industry plays a crucial role in balancing regional economic disparities and is the UK's largest source of goods exports, selling vehicles to over 150 global markets.

Despite export declines in regions like the EU and North America, the UK maintains strong trade relations in Europe. Asian markets, particularly China and South Korea, represent potential growth areas, although current export dependency remains concentrated in Europe and North America.

Market Trends

The UK vehicle market is gradually rebounding from the pandemic-induced collapse in 2020. While Q2 2020 saw historically low sales, subsequent quarters showed double-digit declines. Pre-BREXIT, the light vehicle market peaked at 3.06 million units in 2016, making it the fourth largest globally. However, post-referendum uncertainty led to a decline in sales and production, with full-year sales in 2020 dropping 29.4%.

The year 2021 witnessed mixed performance, with sales recovering sharply in Q2 but falling in subsequent quarters. Overall, 1.65 million units were sold in 2021, a modest 1% increase over 2019.

Competitive Landscape

The UK automotive market is highly competitive, with notable brand dynamics:

-

Volkswagen remains a market leader despite a slight decline.

-

Audi and BMW experienced growth in market share.

-

Hyundai rose four ranks with a 46.7% sales increase.

-

Top-selling vehicles include the Opel Corsa, Tesla Model 3, and Ford Focus.

Segment Analysis

By Vehicle Type

The market is segmented into Passenger Cars, Commercial Vehicles, and Electric Vehicles (EVs). Passenger cars dominate with 60% market share, driven by brands like Volkswagen and Ford. EV production is rising, with battery electric vehicle manufacturing growing 53% in November 2021, highlighting the UK’s shift towards zero-emission vehicles.

By Sales Type

Sales are classified as Private, Fleet, and Business, with the fleet segment leading at 53.3% market share in 2022. Private and business segments accounted for 44.1% and 2.6%, respectively. Fleet sales typically include company-owned vehicles, dealer demonstrators, and leased cars.

Future Outlook

The UK automotive market is poised for growth, driven by digital transformation, EV adoption, and government sustainability initiatives. However, the sector must address challenges in battery production, global competitiveness, and consumer confidence to maintain momentum. With strategic investment and innovation, the UK can strengthen its position in the global automotive industry while contributing significantly to economic growth and sustainability goals.

Find out where the real opportunities lie! Get your free report sample today by clicking here:https://www.maximizemarketresearch.com/request-sample/86645/

Key Players in the UK Automotive Market

-

Aston Martin

-

Bentley

-

Caterham Cars

-

Daimler

-

Jaguar

-

Lagonda

-

Land Rover

-

Lister Cars

-

Lotus

-

McLaren

-

MG

-

Mini

-

Morgan

-

Rolls-Royce