Skateboarding has transitioned into a globally recognized activity with strong commercial foundations. What began as a grassroots movement has matured into an organized industry supported by professional competitions, lifestyle branding, and expanding consumer awareness. This transformation has elevated skateboarding into a reliable revenue-generating segment within the broader sports and recreation economy.

Demand for skateboards is influenced by demographic diversity and shifting leisure preferences. Younger consumers remain a core audience, but participation among adults is increasing due to fitness awareness and nostalgia-driven interest. Parents are also introducing skateboarding to children as a recreational and developmental activity, contributing to multi-generational demand patterns across regions.

Technological advancement plays a significant role in shaping purchasing decisions. Improvements in deck construction, wheel resilience, and bearing efficiency enhance ride quality and durability. Consumers are willing to invest in products that offer better performance and longer lifespans. This willingness directly affects the Skateboard Market valuation by supporting premium pricing strategies alongside entry-level offerings.

Geographically, demand growth varies by region but shows positive momentum overall. North America and Europe continue to dominate consumption due to established skate culture and supportive infrastructure. Meanwhile, Asia-Pacific markets are witnessing faster adoption rates driven by urban population growth, rising disposable incomes, and increasing exposure to global sports trends. These factors collectively contribute to an expanding consumer base.

Retail evolution also impacts industry valuation. Traditional brick-and-mortar stores remain relevant for experiential purchases, but online retail significantly expands reach. Digital platforms allow brands to target specific customer segments with tailored messaging and product recommendations. This omnichannel presence enhances sales efficiency and improves overall market scalability.

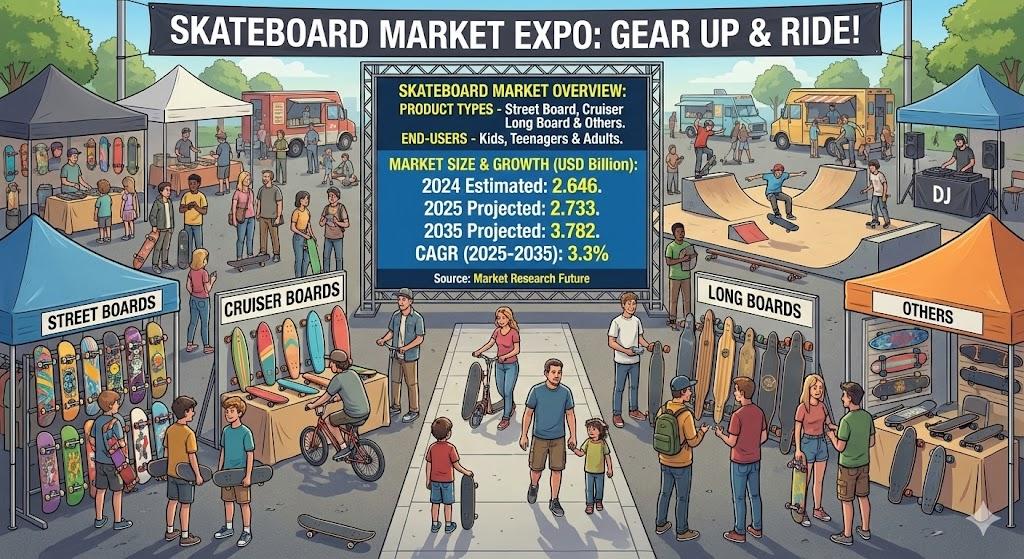

Understanding Skateboard Market Size requires analyzing volume sales, pricing trends, and consumer segmentation. Entry-level skateboards typically dominate unit sales, while professional-grade boards contribute higher revenue margins. Accessories such as wheels, trucks, and protective gear further add to overall revenue streams, making the ecosystem more diverse and resilient.

Marketing strategies have also evolved to support demand expansion. Brands increasingly rely on athlete endorsements, video content, and community engagement to connect with consumers. Skateboarding culture values authenticity, making organic storytelling more effective than traditional advertising. Successful campaigns often highlight creativity, freedom, and individuality rather than purely technical features.

Urban planning initiatives indirectly support demand growth as well. Public skate parks, recreational zones, and youth sports programs encourage participation and normalize skateboarding as a mainstream activity. Such infrastructure investments reduce barriers to entry and promote consistent product replacement cycles as users advance their skills.

Price sensitivity remains an important consideration, particularly in developing economies. Manufacturers address this by offering a wide range of products at different price points without compromising safety or quality. This tiered approach allows brands to capture new users while retaining experienced riders seeking performance upgrades.

In conclusion, the skateboard sector’s valuation is shaped by cultural relevance, technological progress, and diversified demand drivers. As participation broadens and retail channels become more efficient, the industry’s economic footprint continues to strengthen. These dynamics indicate a stable foundation for long-term expansion and sustained commercial interest worldwide.