Global Blockchain-as-a-Service Market: Growth Drivers, Industry Trends, and Forecast (2024–2030)

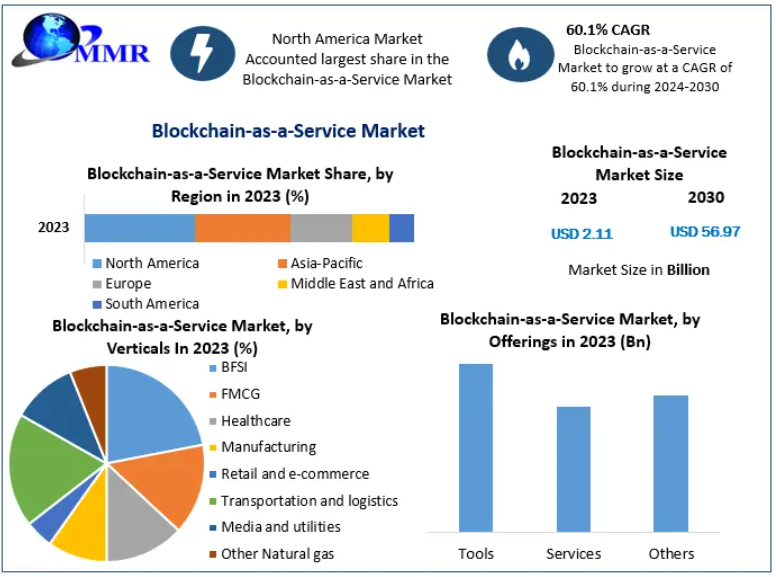

The global Blockchain-as-a-Service (BaaS) market was valued at US$ 2.11 billion in 2023 and is projected to surge to nearly US$ 56.97 billion by 2030, expanding at a remarkable CAGR of 60.1% during the forecast period. This exponential growth reflects the rising demand for scalable, secure, and cost-efficient blockchain infrastructure across industries.

Market Overview

Blockchain-as-a-Service (BaaS) refers to cloud-based blockchain infrastructure and services provided by third-party vendors, enabling organizations to build, host, and manage blockchain applications without developing and maintaining their own blockchain networks. Similar to traditional cloud hosting models, BaaS allows enterprises to leverage blockchain capabilities while outsourcing complex backend operations such as node management, security, maintenance, and scalability.

Originally popularized through cryptocurrency applications, blockchain technology has evolved far beyond digital currencies. Today, it supports secure transactions, immutable record-keeping, decentralized data sharing, and smart contracts across diverse use cases. However, the technical complexity and administrative burden associated with blockchain deployment have limited adoption—particularly among small and mid-sized organizations. BaaS addresses these challenges by providing ready-to-use blockchain platforms hosted in cloud environments.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/165026/

Market Dynamics

Rapid Adoption by Startups and SMEs

One of the most significant drivers of the blockchain-as-a-service market is its growing adoption among startups and small and medium-sized enterprises (SMEs). These organizations often lack the technical expertise and financial resources required to develop in-house blockchain infrastructure. BaaS enables them to experiment with and deploy blockchain solutions without substantial upfront investments.

By outsourcing blockchain operations, SMEs gain access to secure data management, decentralized systems, reduced reliance on intermediaries, and enhanced transparency, all of which deliver strong cost-benefit advantages. BaaS solutions are increasingly used in identity verification, payment processing, supply chain monitoring, and data security, helping businesses address inefficiencies and trust-related challenges.

Supply Chain Transformation through BaaS

Supply chain management has emerged as one of the most impactful application areas for BaaS. Traditional supply chains often rely on siloed data systems that are difficult to manage as operations scale. Blockchain technology enables a shared, decentralized digital ledger, providing a tamper-proof record of transactions and product movement across the supply chain.

Blockchain-as-a-Service platforms allow organizations to integrate supply chain partners seamlessly, offering end-to-end visibility, real-time tracking, and improved accountability. As supply networks expand, additional participants can be easily added to the blockchain by deploying new nodes, enabling businesses to scale operations efficiently.

Real-time blockchain data also supports improved decision-making by delivering actionable insights and performance indicators, helping companies proactively manage demand, inventory, and logistics.

Real-World Industry Applications

Leading enterprises are actively deploying BaaS solutions to enhance transparency and consumer trust. For example, IBM’s blockchain-based solutions enable customers to trace the origin of coffee products by scanning QR codes, offering insights into sourcing and sustainability practices. Similarly, Starbucks, in collaboration with Microsoft, is developing a blockchain-enabled supply chain platform that allows customers to track coffee from farm to cup.

These use cases highlight the growing role of BaaS in improving traceability, sustainability, and customer engagement across industries.

Segment Analysis

By Organization Size

Based on organization size, the market is segmented into SMEs and large enterprises, with SMEs expected to dominate during the forecast period. Blockchain technology offers SMEs enhanced security, faster transactions, reduced fraud risks, and improved access to financial services. By enabling secure and automated data exchange, blockchain helps SMEs overcome challenges related to financing, global expansion, and operational transparency.

Globally, SMEs account for nearly 90% of businesses and 50% of employment, making their adoption of BaaS critical to economic growth. Blockchain technology also helps address funding gaps by improving trust, credit transparency, and digital identity verification.

By Vertical

The BFSI (Banking, Financial Services, and Insurance) segment held the largest market share in 2023. Traditional cross-border payments involve high fees, multiple intermediaries, and long settlement times. Blockchain-based payment systems eliminate intermediaries, reduce transaction costs, and significantly improve transaction speed and transparency.

Increased demand for digital ledgers, smart contracts, governance and compliance solutions, and secure cross-border payments continues to drive BaaS adoption in BFSI. Other major verticals adopting BaaS include retail and e-commerce, manufacturing, healthcare, logistics, media, and utilities.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/165026/

Regional Insights

North America

North America dominated the global blockchain-as-a-service market in 2023, accounting for approximately 45% of total revenue. Strong investment in blockchain innovation, a mature cloud ecosystem, and the presence of major technology companies have fueled regional growth. The United States leads adoption, driven by extensive blockchain development initiatives and integration with public and enterprise services.

Canada and Mexico are also witnessing rapid growth, supported by increasing digital transformation and favorable innovation ecosystems. The widespread adoption of cloud-based BaaS platforms is expected to further accelerate regional expansion through 2030.

Other Regions

Asia Pacific is emerging as a high-growth region due to rapid digitalization, rising enterprise adoption, and increasing government support for blockchain initiatives. Europe continues to adopt BaaS across financial services, supply chain, and public-sector applications, while the Middle East, Africa, and South America are gradually expanding adoption through fintech and logistics use cases.

Competitive Landscape

The blockchain-as-a-service market is highly competitive, led by global technology giants and consulting firms offering integrated cloud and blockchain solutions. Major players focus on expanding platform capabilities, cross-cloud compatibility, and enterprise-grade security.

Leading companies such as Amazon, Microsoft, IBM, Oracle, SAP, and Alibaba provide BaaS solutions that simplify blockchain deployment and management. Specialized platforms like Kaleido offer advanced governance tools, multi-protocol support, and enterprise-ready deployment models, enabling faster adoption across industries.

Amazon Managed Blockchain, for example, allows enterprises to build and manage both private and public blockchain networks with minimal configuration, making it a preferred choice for organizations already operating within AWS ecosystems.

Conclusion

The global Blockchain-as-a-Service market is entering a phase of explosive growth, driven by rising enterprise adoption, expanding SME participation, and increasing demand for secure, decentralized digital infrastructure. By lowering technical barriers and reducing operational complexity, BaaS is democratizing blockchain technology across industries. As organizations seek transparency, scalability, and efficiency, Blockchain-as-a-Service is poised to become a foundational pillar of the global digital economy through 2030.