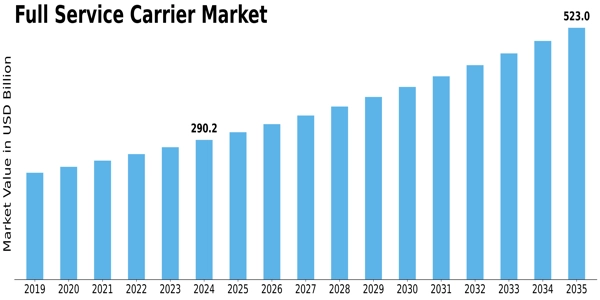

Full Service Carrier Market Introduction

No growth comes without risks. For FSCs, the path ahead is fraught with challenges from multiple fronts.

1. Fierce Competition from LCCs & Hybrids

-

LCCs aggressively undercut pricing, drawing away price-sensitive flyers. Some are even encroaching on medium-haul FSC territory.

-

The pressure forces fare compression and margin erosion.

2. Volatile Operating Costs

-

Fuel constitutes a large share of costs; fluctuations in crude oil and jet fuel prices can upend projections.

-

Labor costs, maintenance, parts, landing fees, and regulatory levies add to cost risk.

3. Regulatory & Environmental Pressure

-

Stricter emissions regulations, carbon taxes or cap-and-trade, noise limits, slot constraints and airport congestion pose constraints.

-

FSCs may have to invest heavily in greener technologies, impacting short-term profitability.

4. Demand Volatility & Macroeconomic Weakness

-

Economic downturns, recessions, geopolitical crises, pandemics or security disruptions can sharply reduce demand for premium travel.

-

Demand elasticity is more pronounced in higher fare segments.

5. Asset & Fleet Risks

-

High capital expenditure on aircraft and engines — underutilization or grounding risks.

-

Rapid technological obsolescence; older planes become less efficient.

6. Brand & Differentiation Risks

-

If ancillary monetization is overdone, the “full service brand” may erode, alienating loyal high-value customers.

-

Maintaining consistency across multiple service touchpoints is challenging.

Conclusion

For full service carriers, balancing growth ambitions with prudent risk management is essential. The winners will be those that manage cost, optimize operations, and build resilient models.