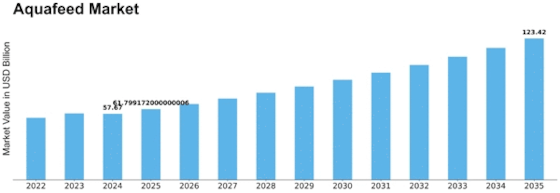

The global aquafeed market is on a powerful upward trajectory, and if MRFR’s latest forecast is anything to go by, the future looks very bright. According to MRFR, the aquafeed market was valued at USD 57.67 billion in 2024 and is projected to nearly double to USD 123.42 billion by 2035, driven by a strong compound annual growth rate (CAGR) of 7.16% over the 2025–2035 period.

One of the primary growth engines behind this surge is the rising global demand for seafood. As wild fish stocks struggle to keep up, aquaculture is stepping in to fill the gap—and that means more feed is needed to sustain the growth. This demand is not just about volume; producers increasingly seek high-quality, nutritionally optimized feed that helps fish and crustaceans grow efficiently and healthily, minimizing waste and maximizing yields.

Sustainability is also playing a critical role in shaping the aquafeed market Size future. Feed manufacturers are innovating aggressively, moving away from conventional fishmeal and oil toward alternative ingredients, such as plant-based proteins and other renewable sources. These greener formulations not only reduce reliance on wild-caught fish but also align with environmental expectations and cost pressures.

Technological advancement further strengthens the momentum. MRFR highlights that precision nutrition, advanced processing, and smarter feed delivery systems are helping aquafeed producers optimize conversion ratios. With tools that tailor feed to specific species, life stages, and growth needs, aquaculture farms can significantly improve efficiency—boosting production, reducing feed waste, and increasing profitability.

Geographically, the market dynamics are particularly interesting. While North America continues to be a major player, Asia-Pacific is the fastest-growing region for the aquafeed market, fueled by soaring aquaculture activity in countries like China, India, and Vietnam. The combination of expanding farmed seafood production and rising investment in sustainable practices is creating a fertile ground for feed manufacturers.

Competition is heating up, with major players such as Cargill, Nutreco, Skretting, BASF, Alltech, ADM, Mowi, Cermaq, Biomar, and Evonik leading the charge. These companies are not simply producing feed—they’re driving the future of aquaculture through R&D, strategic partnerships, and sustainable ingredient sourcing.

In short, the aquafeed market’s impressive growth forecast is underpinned by a powerful convergence of demand, sustainability, and innovation. For investors, feed manufacturers, and farmers alike, the path to 2035 offers enormous opportunity: scale, resilience, and environmental impact are all on the line—and for those who play it right, the rewards could be significant.