Global Logistics Market: Trends, Opportunities, and Future Outlook (2025–2032)

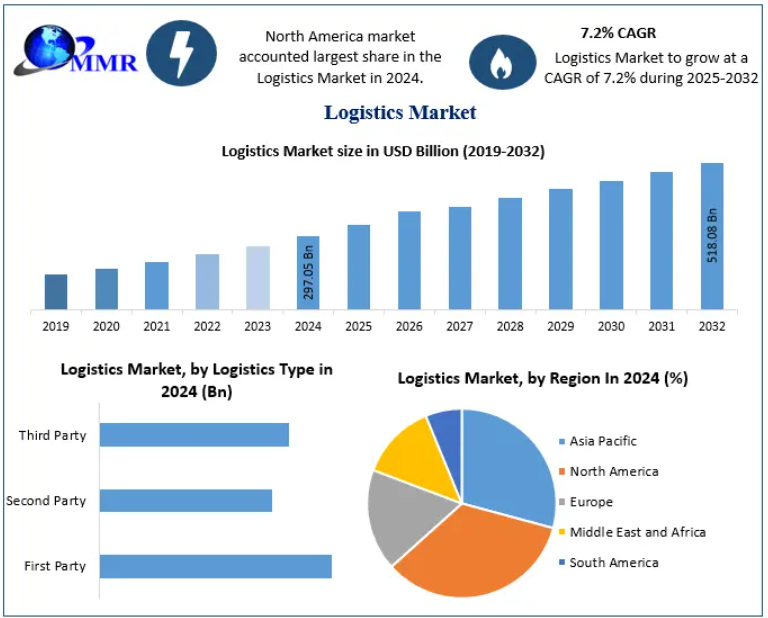

The Global Logistics Market, valued at USD 297.05 Billion in 2024, is poised to reach USD 518.08 Billion by 2032, expanding at a CAGR of 7.2%. As global supply chains evolve and customer expectations shift toward speed, transparency, and efficiency, the logistics industry is undergoing its fastest transformation in history. Technology integration, e-commerce expansion, and greater emphasis on sustainability are shaping the future landscape of logistics across all major economies.

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/94795/

Market Overview

Logistics encompasses the strategic planning, execution, and oversight of the movement and storage of goods—from raw materials to the end customer. It involves transportation, warehousing, distribution, inventory management, and data coordination across the supply chain.

With globalization, the rise of omni-channel retail, and rapid digitalization, logistics has become a core business function rather than a back-end operation. Companies across all industries increasingly rely on sophisticated logistics systems to improve delivery speed, reduce costs, and enhance customer satisfaction.

Market Dynamics

1. Growth Drivers

a. Globalization & Growing Trade Ecosystem

Trade liberalization and free trade agreements have boosted cross-border commerce, creating demand for efficient transportation, customs handling, and global distribution networks.

Regions like the US, China, and the EU are leading this push, supported by improved manufacturing and export capabilities.

b. Explosive E-commerce Growth

E-commerce is the strongest growth catalyst in the logistics market.

Same-day and next-day delivery expectations have reshaped supply chain models, accelerating investments in:

- Micro-fulfillment centers

- Automated sorting hubs

- Last-mile innovations

- Real-time inventory visibility

Asia Pacific, especially China, remains the global hub of e-commerce logistics.

c. Technological Advancements

Logistics is transitioning into a highly digital, automated ecosystem. Key innovations include:

- IoT-powered fleet tracking

- Warehouse robotics

- Digital freight matching

- AI-based route optimization

- Blockchain-based transparency

Platforms like Project44, FourKites, and FreightVerify are revolutionizing real-time logistics visibility.

d. Economic Growth & Job Creation

The logistics sector is one of the world’s biggest employment generators.

Countries like India and Vietnam are benefiting from expanding warehousing, transportation, and distribution networks that support industrialization.

e. Sustainability-Driven Logistics

With rising environmental consciousness, companies are shifting toward:

- Electric delivery fleets

- Low-emission warehouses

- Eco-friendly packaging

- Green logistics certifications

Europe, particularly Germany, leads in sustainable supply chain practices.

2. Market Restraints

a. Logistical Inefficiencies

Challenges such as poor infrastructure, fragmented supply chains, and high transportation costs hamper growth in developing markets.

b. Environmental Impact

Heavy reliance on fuel-based transportation contributes to greenhouse gases. The shift toward greener alternatives requires significant investment.

c. Geopolitical & Regulatory Barriers

Trade wars, border restrictions, and complex customs regulations create recurring disruptions.

Recent examples include:

- US-China trade tensions

- European cross-border standardization issues post-Brexit

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/94795/

Segment Analysis

1. By Transportation Mode

- Roadways – 33.19% Share (Largest Segment)

Dominates due to vast distribution networks and flexible point-to-point delivery. Critical for e-commerce and perishable goods. - Airways – Fastest-Growing Segment

Demand surges from cross-border e-commerce and urgent shipments. - Railways & Waterways

Preferred for bulk cargo and sustainable long-distance transport.

2. By Logistics Type

Third-Party Logistics (3PL) – 39.24% (Dominant Segment)

3PL providers offer integrated warehousing, transportation, packaging, inventory management, and fulfillment solutions.

Industries prefer outsourcing logistics to cut costs and increase operational efficiency.

3. By End-Use Industry

Manufacturing – 29.81% Share (Largest Segment)

Relies heavily on just-in-time delivery and global supply chain networks.

Healthcare – Fastest Growth (CAGR 5.8%)

Growth is driven by pharmaceutical distribution, medical devices, and temperature-controlled logistics.

Other key industries include retail, BFSI, aerospace, media, and telecommunications.

Regional Insights

North America

- Mature, technologically advanced logistics ecosystem

- Dominated by FedEx, UPS, XPO, JB Hunt

- Strong last-mile delivery demand from e-commerce

- Emphasis on green logistics and automation

Asia Pacific (Fastest-Growing Market)

- China is the world’s largest logistics hub

- India is becoming a warehousing and last-mile powerhouse

- Investments in smart infrastructure and digital freight solutions

- Rapid rise of middle-class consumers driving retail logistics

Europe

- Highly structured and sustainable logistics network

- Leading in environmental standards and green supply chain adoption

- DHL, DB Schenker, and Maersk dominate the region

- Emphasis on rail freight and cross-border efficiency post-Brexit

Latin America

- Growth driven by e-commerce expansion

- Challenges include weak infrastructure and complex regulations

- Brazil and Mexico lead regional market development

Middle East & Africa

- Key logistics gateway with massive infrastructure investments

- UAE (Dubai) is a global logistics hub

- Africa shows rising demand due to urbanization and digital commerce

Access your free report sample — uncover the top-performing segments today: https://www.maximizemarketresearch.com/request-sample/94795/

Competitive Landscape

The logistics market is highly competitive and innovation-driven. Companies are focusing on:

- AI-enabled supply chain solutions

- Autonomous delivery vehicles

- Electric fleets

- Global warehousing expansion

- Strategic partnerships & acquisitions

Example Collaboration:

FedEx × Floship: A strategic global partnership creating a unified digital returns and fulfillment platform for e-commerce brands—enhancing efficiency, global reach, and real-time tracking

Key Players in the Global Logistics Market

- CEVA Logistics

- Lineage Logistics

- DHL

- Geodis Logistics

- Americold Logistics

- C.H. Robinson

- Expeditors

- DHL Supply Chain

- Kerry Logistics

- Expeditors International

- GXO Logistics

- Kuehne + Nagel

- Maersk

- DHL Service Point

- J.B. Hunt

- XPO

- DSC Logistics

- JD Logistics

- APL Logistics

- Ryder

- Lineage Logistics

Conclusion

The global logistics industry is entering a transformative era shaped by:

- Digitalization

- Sustainability

- Automation

- E-commerce

- Infrastructure modernization

As companies aim to achieve faster deliveries, cost optimization, and higher visibility, the logistics market will continue to expand aggressively through 2032.