India Automotive Aftermarket: Growth Outlook, Trends, Opportunities & Regional Insights (2024–2030)

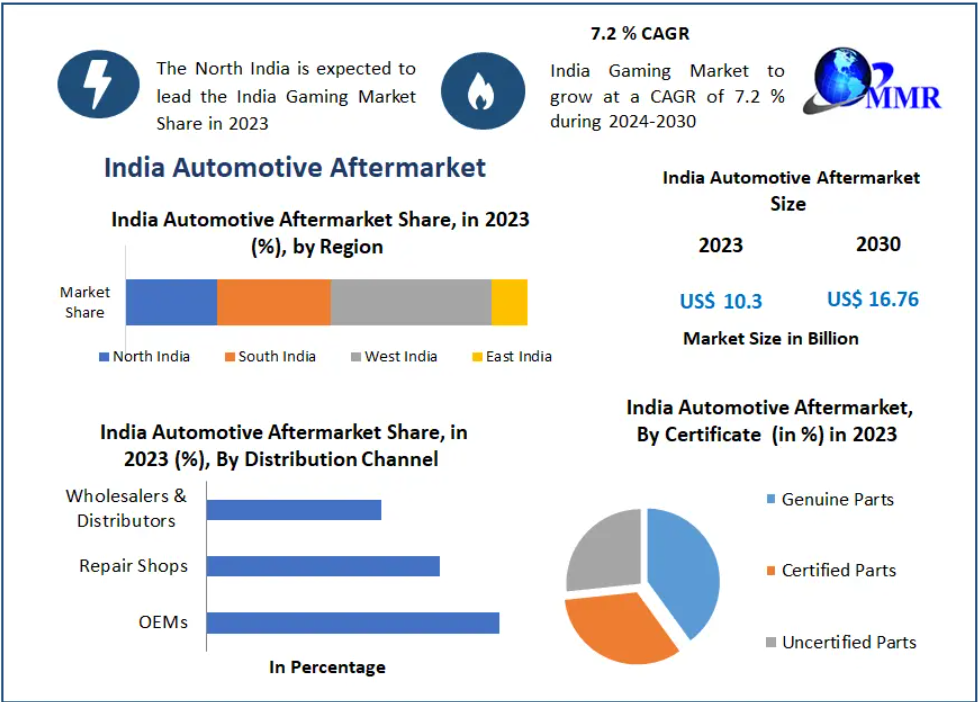

The India Automotive Aftermarket, valued at USD 10.3 billion in 2023, is poised to expand to USD 16.76 billion by 2030, registering a CAGR of 7.2%. This rapid growth is fueled by India’s expanding vehicle parc, evolving mobility patterns, technological shifts, and rising demand for replacement parts and value-added services.

Market Overview

India’s vehicle population has reached an impressive 340 million units, and is projected to grow at 8%+ CAGR over the next five years. This surge directly enhances aftermarket demand for replacement components, repairs, diagnostics, accessories, and service solutions.

Key segments driving this growth:

- Two-Wheelers: Expected to rise from 257 to 365 million units

- Passenger Vehicles: Will expand from ~47 million to over 72 million units

Alongside domestic consumption, India is emerging as a strong exporter of aftermarket components across mature and developing international markets, including:

Indonesia, LATAM, Bangladesh, Brazil, Poland, South Africa, East & West Africa, North Africa, Colombia, and the UAE.

India’s strategic manufacturing capabilities and cost-efficiency make it a competitive player in global aftermarket supply chains.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/29939/

Transformative Trends Shaping the India Automotive Aftermarket

1. Shift Toward Digital Distribution & E-Commerce

The traditional dealer-driven, sequential sales model is being replaced by direct distribution through online channels. Partnerships between OEMs and major e-commerce companies are redefining customer experience.

Example:

Bosch’s collaboration with TMall generated an impressive GMV of USD 290 million (2015–16), showcasing the scale digital channels can deliver.

2. Evolving Revenue Mix

Historically, the aftermarket has been dominated by wear-and-tear parts. However:

- Improved OEM part quality is slowing replacement frequency

- Reduced crash-related damage due to advanced vehicle safety features

- Diagnostics, predictive maintenance, telematics, and car-data–driven services are emerging as new growth pillars

Connected vehicles with IoT sensors allow proactive issue detection—creating demand for software-centric aftermarket services.

3. Rising Influence of Connected & Intelligent Vehicles

Predictive analytics, remote diagnostics, and AI-based maintenance systems are transforming the aftermarket into a tech-enabled service ecosystem.

Growth Drivers

1. Surge in Vehicle Sales

According to MMR’s January 2024 report:

- Overall vehicle sales rose 15% YoY

- Passenger vehicles grew 13%

- Two-wheelers increased 15%

- Three-wheelers surged 37%

- Tractors expanded 21%

Record-breaking monthly volumes in January 2024 (• Passenger vehicles: 3,93,250 units) highlight the rising need for aftermarket repair, maintenance, and parts replacement.

2. Rural Demand & New Launches

Factors supporting sales momentum:

- Improved rural income due to favorable agricultural conditions

- Strong marriage season demand

- Successful new model introductions

- Post-budget policy boosts

These translate into increased long-term aftermarket consumption.

3. Expansion of Pre-Owned Vehicle Market

India’s used-car market is expected to grow at 17.5% CAGR through FY2030. Higher ownership turnover significantly boosts:

- Parts replacement

- Refurbishment

- Accessories

- Diagnostics

- Service center activity

This sector has become a major aftermarket catalyst.

Market Restraints

Strict Regulatory Environment

Compliance with AIS, BIS standards, emission norms, and safety regulations creates barriers.

Opportunities: Technological Advancements Create New Avenues

Emerging automotive technologies offer multi-billion-dollar opportunities for aftermarket players.

1. Electric Vehicles (EVs)

Aftermarket opportunities include:

- EV charging infrastructure

- Battery management systems

- Retrofitting kits

- Thermal management systems

2. ADAS & Safety Systems

Services in demand:

- Calibration of sensors and cameras

- Installation of crash avoidance systems

- Software updates and reprogramming

3. Connected Vehicle Ecosystem

Opportunities:

- Predictive maintenance

- Telematics dashboards

- GPS-based fleet optimization

- Remote diagnostics

4. 3D Printing & Materials Innovation

Allows:

- Customized components

- Quick prototyping

- Cost-effective low-volume parts manufacturing

These advancements will shape the next phase of aftermarket expansion.

Segment Analysis

By Replacement Parts: Tires Lead the Market

The tire segment dominated the market in 2023 due to:

- High frequency of replacement cycles

- Growing consumer preference for premium, fuel-efficient tires

- Rise in commercial & personal mobility

- Expansion of two-wheeler and passenger vehicle base

India’s tire ecosystem is highly competitive, with brands focusing on technology, distribution optimization, and performance-focused variants.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/29939/

Regional Insights

1. Northern India – Market Leader

Includes Delhi, Uttar Pradesh, Haryana, Punjab.

Drivers:

- Highest vehicle density

- Strong demand across passenger, commercial & agricultural vehicles

- Large network of service centers and retailers

2. Western India – Fast-Growing Market

Includes Maharashtra, Gujarat, Rajasthan.

- Mumbai and Pune fuel premium aftermarket demand

- Gujarat’s industrial belts boost commercial vehicle parts consumption

- Presence of automotive clusters strengthens supply chains

3. Southern & Eastern India – Emerging Potential

- Rising urbanization

- Growing disposable incomes

- Expanding road connectivity

- Increased EV penetration

Each region shows unique aftermarket behavior, requiring tailored distribution and service strategies.

Market Segmentation

By Replacement Parts

- Tires

- Batteries

- Brake Parts

- Filters

- Body Parts

- Lighting & Electronics

- Wheels

- Exhaust Components

- Turbochargers

- Others

By Certification

- Genuine Parts

- Certified Parts

- Uncertified Parts

By Service Channel

- DIY (Do It Yourself)

- DIFM (Do It For Me)

- OE Service Centers

By Distribution Channel

- OEMs

- Repair Shops

- Wholesalers & Distributors

Key Players in the India Automotive Aftermarket

- Bosch India

- TVS Group

- Mahindra & Mahindra

- Exide Industries

- Tata Motors

- Minda Industries

- Amara Raja Batteries

- Ashok Leyland

- Hero MotoCorp

- Maruti Suzuki

- Motherson Sumi Systems

- JK Tyre & Industries

- Lumax Industries

- Sundram Fasteners

- WABCO India

- Gabriel India

- Ceat Ltd.

- SKF India

- MRF Limited

- Apollo Tyres

These companies lead the market through innovation, extensive distribution networks, and strong brand value.

Conclusion

The India Automotive Aftermarket is entering a high-growth phase driven by:

- Rising vehicle ownership

- Digitalization of distribution

- Technological innovation

- Expansion of EVs and connected vehicles

- Growth in rural and pre-owned markets

While regulatory challenges and industry fragmentation persist, the shift toward smarter, tech-enabled aftermarket solutions presents strong opportunities. Companies that invest in digital channels, predictive diagnostics, EV-ready services, and value-driven customer experiences will dominate the next decade of India’s aftermarket landscape.