Automotive Market in India: Growth Outlook, Key Drivers, and Future Opportunities (2023–2030)

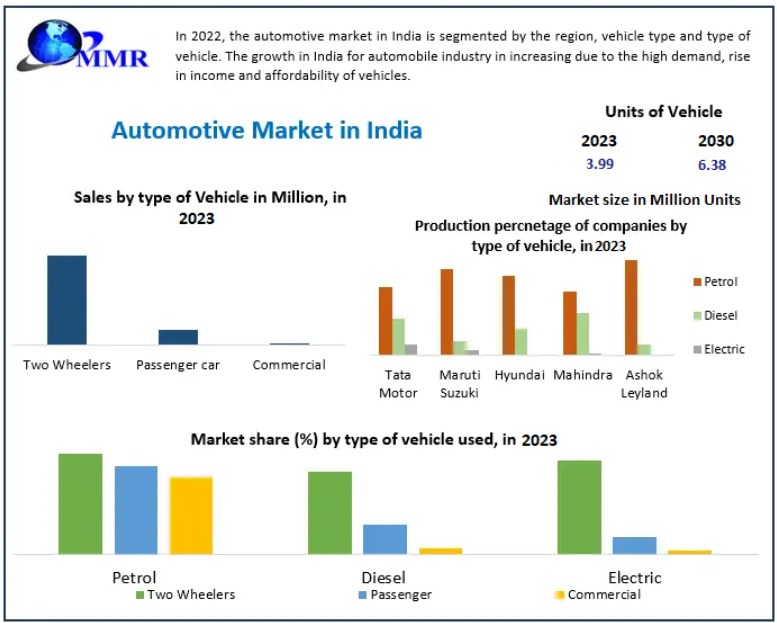

The Automotive Market in India accounted for 3.99 million units in 2023 and is projected to reach 6.38 million units by 2030, expanding at a CAGR of 6.94%. India stands as one of the world’s fastest-growing automobile hubs, driven by strong consumer demand, rapid urbanization, technological advancements, and evolving mobility trends.

Market Overview

The automotive sector in India comprises the production and sale of vehicles across categories such as two-wheelers, passenger vehicles, commercial vehicles, and three-wheelers. Growing income levels, a rising young population, and the demand for efficient mobility solutions have significantly shaped the market landscape. The sector benefits from structured policy support, innovation, and increased investments in electric mobility, advanced manufacturing, and digitalization.

Market analysis involves detailed insights into industry dynamics, segmentation, technological progress, competitive landscape, and regional trends, supported by both primary and secondary research methodologies. With India’s strong push towards sustainability, manufacturers are focusing on eco-friendly, connected, and autonomous mobility solutions.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/86126/

Market Dynamics

1. Rising Vehicle Usage Driving Market Expansion

India's expanding middle class, increasing disposable incomes, and rapid urban development are boosting vehicle sales across categories. As per SIAM, India produced 1.69 million vehicles in June 2021 alone, indicating strong manufacturing resilience.

Government policies promoting hybrid and electric vehicle adoption, along with rising automotive exports—totaling 1.41 million units between April–June 2021—further support industry growth.

2. Technological Costs and Regulatory Pressures Restrain Growth

Despite rapid expansion, the sector faces challenges such as:

- High vehicle costs due to new technology integration (EV batteries, ADAS, autonomous systems)

- Increasing pollution levels prompting strict emission norms

- Frequent policy updates causing operational and compliance delays

- Rural infrastructure issues increasing road safety risks

- Rising fuel prices reducing affordability and dampening consumer buying intent

The shift to EVs requires heavy investment in batteries, charging infrastructure, and R&D, which can push up manufacturing costs.

3. Accelerated R&D Investments Create Growth Opportunities

Government initiatives such as Make in India, Atmanirbhar Bharat, and the Automotive Mission Plan (2016–2026) are transforming India into a global automotive manufacturing and innovation hub.

Key opportunities include:

- Expansion of India’s role as a global engineering R&D center, contributing 40% of the world’s $31 billion automotive R&D spending

- Growing focus on connected and smart vehicles

- Rising EV-related investments, increasing demand for wiring harnesses, sensors, actuators, and lithium-ion batteries

- Strengthening auto-component manufacturing to attract global OEMs

4. Rising Air Pollution Accelerates EV Adoption

High pollution levels in metro cities like Delhi and Mumbai have led to:

- Stricter emission norms (BS-VI)

- EV tax reductions

- Government-backed EV incentives (FAME, state EV policies)

With India poised to surpass China as the world’s most populous country, the need for cleaner mobility is driving accelerated adoption of EVs, especially for urban commuting.

Segment Analysis

By Vehicle Type

1. Two-Wheelers – Dominating Segment

Two-wheelers lead India’s automotive landscape due to:

- Affordability

- Ease of navigation in congested areas

- High mileage

- Deep rural penetration

Most in-demand categories:

- Motorcycles

- Scooters

- Mopeds

Major players: Hero MotoCorp, Bajaj Auto, Honda Motorcycle, TVS Motor Company

2. Passenger Vehicles – Rising with Urbanization

Growth drivers:

- Lifestyle changes

- Increased family income

- Better road infrastructure

- Higher preference for personal mobility post-pandemic

SUVs and compact cars are witnessing the highest growth.

3. Commercial Vehicles – Boosted by Industrial Growth

Commercial vehicles, especially diesel-powered trucks and buses, remain essential due to:

- Growing logistics sector

- E-commerce boom

- Infrastructure modernization

Major manufacturers: Tata Motors, Mahindra & Mahindra, Ashok Leyland

By Fuel Type

1. Petrol Vehicles – Market Leaders

- Cost-effective

- Reliable performance

- Excellent mileage

- Widely available

Still dominate both two-wheeler and passenger car segments.

2. Diesel Vehicles – Strong in Heavy Duty Applications

Dominant in:

- Trucks

- Buses

- Long-distance passenger vehicles

Diesel vehicles are preferred for durability and torque.

3. Electric Vehicles – Fastest Growing Segment

Driven by:

- Pollution control measures

- Government incentives

- EV startup ecosystem

- Falling battery prices

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/86126/

Regional Insights

1. North India – Largest Market

- High population density

- Dominance of two-wheelers and SUVs

- Strong demand for commercial vehicles

2. West India – Strong Commercial Vehicle Hub

- Proximity to major ports

- High agricultural and industrial activity

- Rising demand for luxury cars

3. South India – Hub for Two-Wheelers and IT Workforce

- Most prominent IT and education hub

- High demand for bikes and compact cars

- Strong used-car market

4. East India – Smallest Market

- Limited plain land for driving

- Two-wheelers dominate in accessible regions

Competitive Landscape

Top companies shaping the Indian automotive market include:

- Tata Motors Ltd

- Maruti Suzuki India Ltd

- Mahindra & Mahindra Ltd

- Hero MotoCorp Ltd

- Bajaj Auto Ltd

- Ashok Leyland Ltd

- TVS Motor Company Ltd

- Eicher Motors Ltd

- Force Motors Ltd

- SML ISUZU Ltd

- Honda Motor Co.

- Hyundai Motor India

- Daimler AG

- Piaggio

- Toyota Motor Corp

- Volkswagen AG

- Volvo Group

Tata Motors continues to lead with strong EV adoption (Tata Nexon EV, Tiago EV), while Maruti Suzuki and Hyundai remain strong in PV segments. Increased investment in manufacturing, R&D, and EV infrastructure marks a competitive shift toward sustainable mobility.

Conclusion

The Automotive Market in India is undergoing a major transformation shaped by technological innovation, rising consumer aspirations, government policy support, and the shift toward sustainable mobility. While challenges exist—mainly infrastructure limitations and high technological costs—the long-term outlook remains strong, with India positioned to emerge as a global automotive powerhouse by 2030.