The treasury software market is experiencing strong momentum as organizations prioritize real-time visibility, automated financial workflows, and advanced risk management tools.

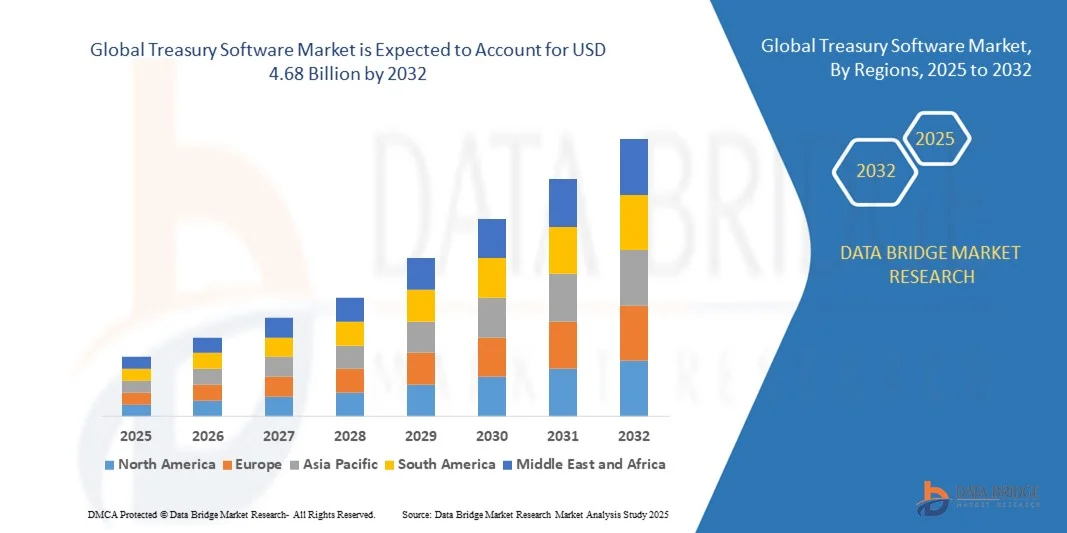

The global treasury software market size was valued at USD 3.67 billion in 2024 and is expected to reach USD 4.68 billion by 2032, at a CAGR of 3.1% during the forecast period

With treasury operations becoming more complex, the market is expanding rapidly, supported by the growing need for accurate cash forecasting, liquidity optimization, and fraud prevention. As businesses shift toward digital-first financial management, the market size continues to grow across sectors such as banking, manufacturing, retail, IT services, and logistics.

Market Size Driven by the Need for Real-Time Financial Intelligence

The rising adoption of automation in treasury operations is a major factor boosting the treasury software market. Companies are increasingly implementing integrated treasury platforms to manage cash positions, banking relationships, and short-term investments more effectively. This demand is contributing significantly to the overall market size, with organizations looking to replace manual processes with centralized digital systems.

Cloud-based treasury solutions, in particular, are transforming the market landscape. As enterprises aim for rapid deployment, improved scalability, and reduced IT overhead, cloud platforms have become the preferred choice—enabling faster integration, enhanced data security, and real-time financial insights.

Growing Market Share Supported by Industry Digitalization

The market share of treasury software continues to expand as financial leaders seek better control over liquidity and risk. Treasury systems that integrate seamlessly with ERP platforms and banking networks are gaining prominence due to their ability to automate reconciliation, streamline payments, and improve compliance reporting.

The strategic shift toward digital treasury operations across large enterprises and SMEs has strengthened the market’s position. Additionally, the rise in cyber risks and payment fraud has elevated demand for advanced treasury tools equipped with fraud analytics, user authentication, and multi-layered security frameworks.

Market Segmentation: Diverse Applications Across Industry Verticals

The treasury software market is segmented based on deployment type, organization size, end-use industry, and functionality. Key segments include:

1. Deployment: Cloud-Based and On-Premise

Cloud deployment is witnessing rapid growth due to minimal infrastructure requirements and lower upfront investments.

2. Organization Size: Large Enterprises and SMEs

While large enterprises have traditionally led adoption, SMEs are steadily increasing their usage to enhance cash visibility and financial planning.

3. End-Use Industries

Banking & financial services, manufacturing, energy, retail, telecom, and logistics are among the largest users of treasury software.

4. Functionality

Cash management, liquidity optimization, financial reporting, payments processing, and risk analytics represent major functional segments.

Trend Analysis: Key Factors Influencing Market Growth

Several emerging trends are shaping the future of the treasury software market:

1. Shift Toward AI and Machine Learning

AI-driven treasury tools are enabling more accurate cash forecasting, automated anomaly detection, and intelligent investment recommendations.

2. Integration with Real-Time Payments

With global adoption of instant payment systems, treasury platforms are evolving to support faster settlement and automated payment reconciliation.

3. Rise of API-Enabled Treasury Connectivity

APIs are improving communication between treasury systems, banks, and ERP tools—making real-time financial data more accessible.

4. Increased Focus on Cybersecurity

Organizations are enhancing their treasury systems with multi-factor authentication, end-to-end encryption, and fraud monitoring algorithms.

Browse More Reports:

Global Hybrid Imaging Market

Global Indirect Debris Removal Market

Global Integrated Labelling System Market

Global Low Emission Vehicles Market

Global Metal Carboxylate Market

Global Microcontroller for Parking Assist System Market

Global Micro-Perforated Food Packaging Market

Global Mortuary Equipment Market

Global Non-volatile Memory Express Market

Global Obesity Treatment Market

Global Ophthalmic Packaging Market

Global Organic Asphalt Modifiers Market

Global Printed Tape Market

Global Propionic Acid for Animal Feed Market

Global Rear Electric Axle (E-Axle) Market

Future Outlook

The treasury software market is expected to maintain strong growth as enterprises continue prioritizing automation, operational transparency, and financial resilience. With digital transformation initiatives accelerating globally, treasury systems will play a central role in enabling better decision-making and improving financial governance.

Organizations embracing advanced treasury solutions will benefit from stronger liquidity management, enhanced compliance, and improved strategic planning—ensuring they remain competitive in an increasingly dynamic economic environment.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]