Global Prepaid Card Market: Growth, Trends, Dynamics, and Forecast (2024–2030)

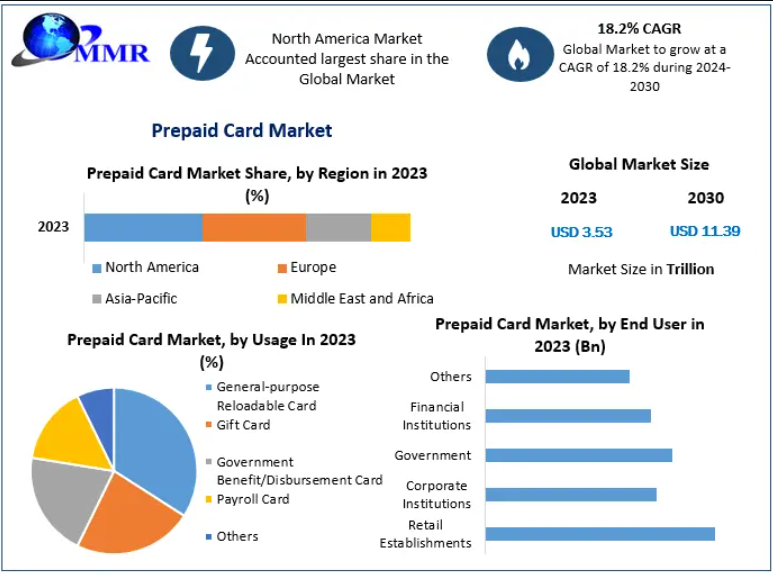

The Global Prepaid Card Market, valued at USD 3.53 trillion in 2023, is poised for significant expansion, projected to reach USD 11.39 trillion by 2030, growing at a CAGR of 18.2% during the forecast period. The surge in demand for digital transactions, increasing financial inclusion, and a shift toward cashless economies are the key driving forces behind this rapid market evolution.

Market Overview

A prepaid card—also referred to as a prepaid debit card or stored-value card—allows value to be loaded through multiple methods such as cash deposits, online transfers, and direct deposits. These cards function independently of traditional bank accounts while offering the convenience of electronic payments.

Growing preference for cash alternatives, especially in corporate, retail, and personal transactions, is pushing adoption worldwide. Prepaid cards offer:

- Controlled spending

- Enhanced safety compared to cash

- Wide acceptance in online and offline payments

As cashless ecosystems mature, prepaid cards are replacing cash, checks, and traditional debit/credit cards, especially among unbanked and underbanked populations.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/110670/

Market Dynamics

- Diversification of Financial Services Boosting Prepaid Card Adoption

Banks and financial institutions are increasingly integrating prepaid cards into ATM and POS networks, enhancing usability.

Key contributing factors include:

- Rising internet penetration in the banking sector

- Transition from traditional instruments (cheques, drafts) to modern payment options

- Growing preference for digital banking solutions

Financial institutions are leveraging prepaid cards to modernize payment ecosystems, thereby accelerating market growth.

- Rising Use of Prepaid Cards in Cross-Border Remittances

The global migrant workforce is driving demand for secure, low-cost, and accessible money transfer solutions.

Prepaid cards offer:

- Faster access to remitted funds

- Lower transfer fees

- Enhanced security

- Competitive exchange rates

As remittance volumes continue to rise, prepaid cards are becoming a preferred instrument for sending and receiving funds globally.

- Growth of the E-Commerce Industry Fueling Demand

The ongoing expansion of e-commerce, digital marketplaces, and online services is a major growth catalyst.

Consumers prefer prepaid cards due to:

- Seamless online payments

- Privacy protection

- Reduced fraud risks

- Global transaction capability

The digital transformation wave—driven by mobile wallets, fintech platforms, and virtual prepaid cards—is significantly accelerating market penetration.

- Market Challenges: Lack of Standardization and Security Concerns

Despite promising growth, the prepaid card market faces notable challenges:

- Lack of uniform regulatory frameworks across countries

- Fraud risks, identity theft, and unauthorized transactions

- Concerns related to anonymous usage of prepaid cards

- Limited consumer awareness in emerging markets

These factors may slow adoption unless addressed through stronger compliance frameworks and secure technology integrations.

Prepaid Card Market Segment Analysis

By Card Type

Closed-Loop Prepaid Cards (Dominant Segment in 2023)

Widely adopted by:

- Retailers

- Travel agencies

- Educational institutions

Closed-loop cards offer controlled usage within specific merchant ecosystems, making them ideal for gift cards and loyalty programs.

Open-Loop Prepaid Cards (Fastest Growing Segment)

These cards are accepted across global POS, ATM, and online platforms, offering:

- High flexibility

- Lower fraud risks

- ATM withdrawal capability

- Wide acceptance similar to debit/credit cards

Open-loop cards are gaining prominence due to their versatility and convenience.

By Usage

- Gift Cards (Largest Segment in 2023)

Popular for:

- Retail shopping

- Online purchases

- Corporate gifting

Gift cards dominate due to convenience and rising consumer gifting trends.

- Payroll Cards

Used by businesses to:

- Disburse employee salaries

- Pay incentives and reimbursements

These cards reduce payroll processing complexities and are widely adopted by gig-economy employers.

Other Usage Types

- General-purpose reloadable cards

- Government disbursement/benefit cards

- Travel and forex cards

- Rewards and loyalty cards

By End User

- Retail Establishments (High adoption of gift and closed-loop cards)

- Corporate Institutions (Payroll and rewards cards)

- Government Bodies (Disbursement cards for benefits and subsidies)

- Financial Institutions (Banking and fintech prepaid products)

- Others (Online services, hospitality, tourism)

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/110670/

Regional Insights

North America (Market Leader in 2023)

North America holds the largest market share due to:

- Strong digital banking ecosystem

- Supportive regulatory initiatives

- High demand among unbanked/underbanked groups

- Rapid penetration of fintech prepaid solutions

The U.S. accounts for more than half of the global prepaid card market.

Asia Pacific (Fastest-Growing Region)

APAC growth is driven by:

- Government-led financial inclusion initiatives

- Rapid digital payment adoption

- Expansion of e-commerce

- Increasing usage in retail and corporate sectors

Countries like India, China, Japan, and Indonesia play pivotal roles in market expansion.

Europe

Europe’s growth is fueled by:

- Expanding fintech industry

- Adoption of travel and multi-currency cards

- Strong regulatory focus on secure digital payments

Middle East & Africa

Growth attributed to:

- Rising mobile money adoption

- Increasing migrant population (remittances)

- Expanding retail sector

South America

Key Growth Factors:

- Growth in fintech startups

- Increased usage of prepaid cards for government subsidies and payroll

Competitive Landscape: Key Players

- Visa, Inc.

- American Express Company

- MasterCard Inc.

- Kaiku Finance, LLC

- Mango Financial, Inc.

- Total System Services, Inc.

- Citigroup

- PNC Financial Services Group, Inc.

- BBVA Compass Bancshares

- Green Dot Corporation

- H&R Block Inc.

- JPMorgan Chase & Co.

- NetSpend Holdings, Inc.

- PayPal Holdings, Inc.

- UniRush, LLC

- Others

Companies are focusing on:

- Partnerships with fintechs

- Launch of virtual prepaid cards

- Blockchain-based transaction security

- Advanced fraud detection tools

Conclusion

The global prepaid card market is on a robust growth trajectory, driven by the transition toward digital payments, increasing financial inclusion, and the rising need for secure, flexible, and cashless transaction platforms. With financial institutions, fintech companies, and governments promoting prepaid ecosystems, the market is poised for transformative growth through 2030.