Global Farm Management Software Market (2024–2030): Industry Analysis, Trends & Forecast

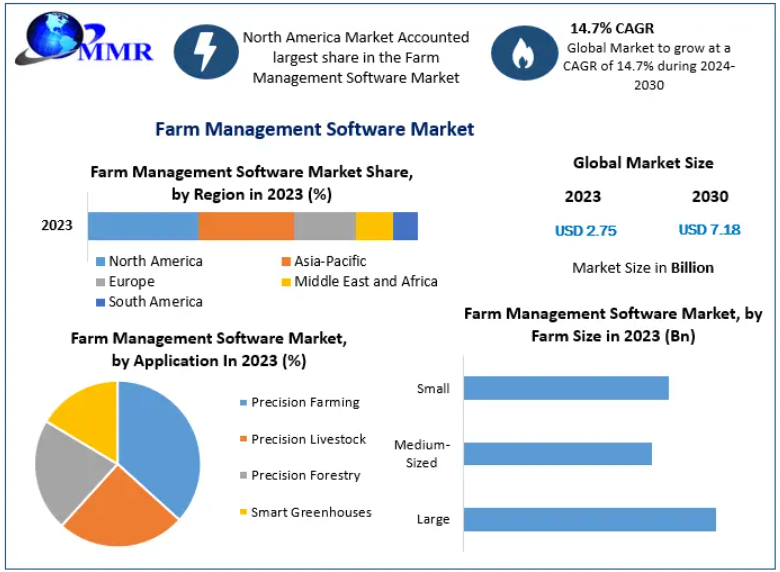

The Global Farm Management Software Market, valued at USD 2.75 billion in 2023, is poised for strong expansion and is projected to reach USD 7.18 billion by 2030, registering a CAGR of 14.7% during the forecast period. The market’s rapid growth is driven by rising digitalization in agriculture, adoption of precision farming, and increasing demand for real-time farm data analytics.

Market Overview

Farm management software (FMS) provides a unified digital ecosystem that enables farmers to monitor, track, and optimize agricultural activities. The software integrates data from GPS devices, satellite imagery, drones, sensors, and IoT systems to support decision-making related to crop production, livestock management, aquaculture, forestry, and greenhouse operations.

Growing emphasis on smart farming and the global need to enhance agricultural productivity are accelerating the adoption of these platforms across large, medium, and even small farms.

Click Here to Receive a Free Sample of the Report:https://www.maximizemarketresearch.com/request-sample/30111/

Market Dynamics

- Driving Forces

✔ Rising agricultural digitalization

Increasing adoption of advanced technologies such as AI, machine learning, IoT, and cloud computing enables real-time monitoring, predictive analytics, and automation of farming operations.

✔ Demand for real-time decision-making

Farm management software helps monitor soil conditions, crop health, moisture levels, feed schedules, and harvesting cycles—allowing farmers to make informed decisions quickly.

✔ Precision agriculture expansion

Precision farming techniques rely heavily on accurate field data, enhancing crop yields and minimizing resource waste. AI-powered algorithms play a growing role in:

- Crop and soil analysis

- Pest detection

- Yield prediction

- Weather forecasting

✔ Increasing protein consumption boosts aquaculture

Precision aquaculture is witnessing rapid adoption as fish farmers use software for:

- Feeding management

- Water quality monitoring

- Growth analysis

This segment is expected to grow fastest during the forecast period.

- Restraining Factors

✘ Limited technical knowledge among farmers

Despite rising affordability, many farmers—especially in developing regions—lack the skills to operate FMS platforms. This leads to slow adoption rates.

✘ Complexity of data interpretation

Farmers often require training in agricultural data analytics, cloud-based tools, and software navigation.

✘ Resistance to change

Traditional farming communities are hesitant to transition to digital systems despite proven benefits.

However, increasing government initiatives, private sector training programs, and agri-tech consultancy services are helping mitigate these barriers.

Market Segmentation

- By Application

- Precision Farming

- Precision Livestock

- Precision Aquaculture (fastest-growing segment)

- Precision Forestry

- Smart Greenhouses

- Others

Precision Aquaculture is expected to hold the highest market share by 2030 due to rising global demand for protein-rich seafood and the increasing use of automated feeding and monitoring systems.

- By Offering

- On-Cloud

- On-Premise

- Data Analytics Services (fastest-growing)

Cloud-based platforms dominate due to low deployment costs, scalability, and remote accessibility. Data analytics services are growing rapidly as farmers seek insights from large data volumes generated by smart farms.

- By Farm Size

- Large Farms

- Medium-Sized Farms

- Small Farms

Large farms lead adoption, especially in North America and Europe, but government subsidies are increasing software uptake among small and medium farmers.

- By Farm Production Planning

- Pre-Production Planning

- Production Planning

- Post-Production Planning

Farm management software is increasingly used across the entire agricultural value chain—from land preparation to storage and supply chain visibility.

Click Here to Receive a Free Sample of the Report:https://www.maximizemarketresearch.com/request-sample/30111/

Regional Insights

North America – Market Leader

North America is projected to dominate the global market through 2030, driven by:

- Large farm sizes

- High awareness and adoption of digital agriculture

- Established presence of global leaders such as John Deere, Trimble, and Raven Industries

The U.S. remains at the forefront of precision agriculture adoption, supported by strong research and technological infrastructure.

Asia Pacific – Fastest Growing Region

Asia Pacific is expected to grow at the highest CAGR due to:

- Rapid population growth

- Increasing food demand

- Government support for smart agriculture

- Growing adoption of precision farming techniques

Countries like China, Japan, and India are accelerating digital transformation in agriculture.

Competitive Landscape

The market is highly competitive, with global leaders focusing on product innovation, AI-driven analytics, and cloud-based platforms. New entrants are targeting niche applications such as aquaculture and small farm management.

Key Players

- Trimble (US)

- Raven Industries (US)

- Topcon Positioning Systems (US)

- Granular Inc. (Corteva Agriscience) (US)

- Agrivi (UK)

- AgJunction (US)

- Farmers Edge (Canada)

- Agworld (US)

- Deere & Company (US)

- IBM Corporation (US)

- SST Development Group (US)

- The Climate Corporation (US)

- Microsoft Corporation (US)

- Afimilk (Israel)

- Iteris (US)

- GEA Farm Technologies (Ukraine)

- CropX (Israel)

- Conservis (US)

- Cropio (Ukraine)

- CropIn (India)

Competitive Trends

- Integration of AI & ML for predictive analytics

- Strategic partnerships between agri-tech companies and hardware manufacturers

- Expansion of SaaS-based subscription models

- Increasing entry of startups focusing on affordability and local language support

Conclusion

The Global Farm Management Software Market is entering a transformative phase driven by smart agriculture, AI integration, and rising demand for real-time agricultural insights. With governments and private players promoting digital literacy among farmers, adoption is expected to accelerate across developing regions.

By 2030, farm management software will become a core component of modern agriculture, helping farmers increase productivity, reduce resource wastage, and achieve sustainable farming outcomes.