Global Automotive Motors Market Outlook 2025-2032

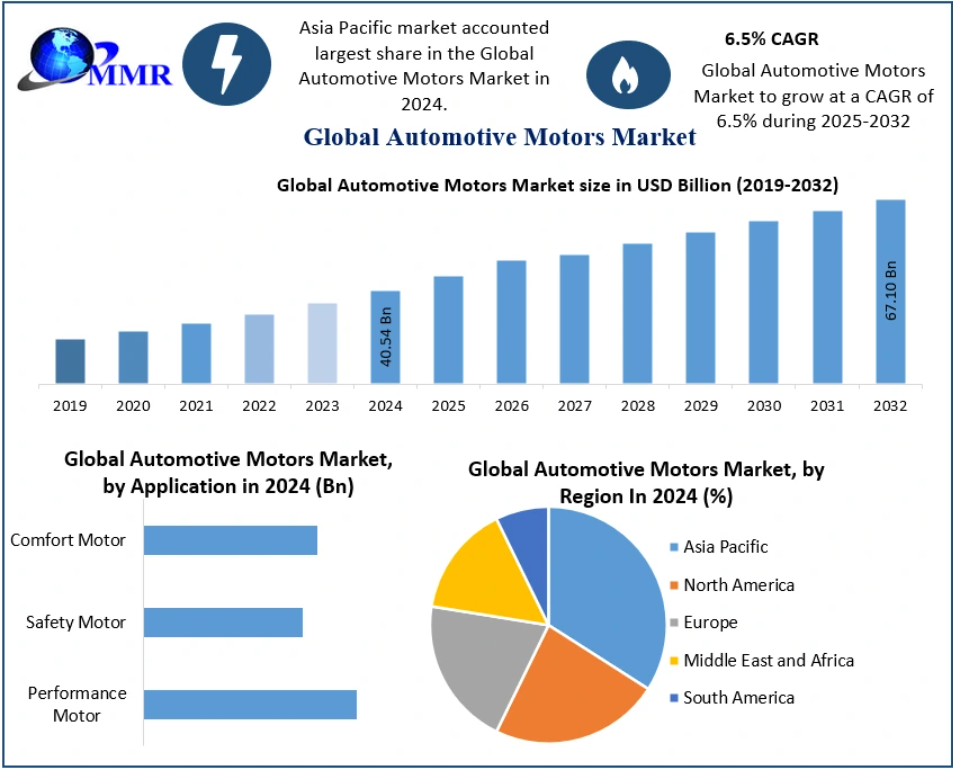

The Global Automotive Motors Market was valued at USD 40.54 billion in 2024 and is projected to grow at a CAGR of 6.5%, reaching approximately USD 67.10 billion by 2032. Automotive motors, critical components in modern vehicles, are designed to enhance vehicle performance, safety, and comfort by powering various systems, from braking and steering to infotainment and climate control.

Market Dynamics and Trends

The market is witnessing significant growth due to increasing adoption of advanced automotive technologies, rising consumer demand for enhanced safety, comfort, and convenience features, and the rapid expansion of electric vehicles. Among motor types, safety motors are expected to dominate, driven by the mandatory integration of safety systems like anti-lock braking systems (ABS) and airbags. In terms of vehicle types, passenger cars represent the fastest-growing segment, fueled by higher adoption of electronics and advanced systems in mid- to high-end vehicles.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/2874/

Key growth drivers include:

- Rising awareness of vehicle safety features and regulations mandating their installation.

- Increasing production of passenger and commercial vehicles in emerging economies, particularly in Asia-Pacific (APAC).

- Technological advancements in automotive motors by leading manufacturers, particularly in Japan and South Korea.

Market restraints primarily involve the additional weight and cost associated with integrating advanced motors into vehicles, which could slow adoption in certain segments.

Regional Insights

The APAC region is projected to be the fastest-growing market due to:

- High vehicle production volumes in China and India.

- Strong technological presence in Japan and South Korea.

North America and Europe are expected to maintain steady growth, supported by advanced automotive technologies, regulatory frameworks, and rising EV adoption. Meanwhile, the Middle East & Africa and South America markets are expected to grow moderately, driven by gradual industrialization and modernization of transportation infrastructure.

Market Segmentation

By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Application:

- Performance Motors

- Safety Motors

- Comfort Motors

By Product Type:

- DC Brushed Motors

- Stepper Motors

- DC Brushless Motors

By Electrical Vehicle Type:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/2874/

Key Players

The Automotive Motors Market is highly competitive, with global leaders focusing on innovation, strategic partnerships, and regional expansion. Major players include:

- Robert Bosch

- Siemens AG

- Mitsubishi Electric Corporation

- BorgWarner Inc.

- Nidec Corporation

- Mahle Group

- Valeo S.A.

- Denso Corporation

- Magna International

- Brose

- Buhler Motor

- Calsonic Kansei Corporation

- Continental AG

- IFB Automotive

- Johnson Electric Holdings Limited

- Mabuchi Motors Co. Ltd

- Mahle GmbH

- Ricardo

- PST Electronics Ltd

- Meritor, Inc.

Impact of COVID-19

The COVID-19 pandemic affected the Automotive Motors Market differently across regions due to variations in lockdowns and economic slowdown. While some regions experienced supply chain disruptions and production halts, others adapted through digitalization and local manufacturing strategies. The short- and long-term impacts have guided companies to revise strategies, focusing on resilience, localization, and technological innovation.

Conclusion

The global Automotive Motors Market is set for steady growth over the next decade, driven by technological advancements, growing demand for vehicle safety, and increasing penetration of electric vehicles. With APAC emerging as a key growth region and leading players actively innovating, stakeholders—including OEMs, component suppliers, and investors—have opportunities to capitalize on this dynamic market. Strategic planning and regional-specific approaches will be crucial for maintaining a competitive edge.