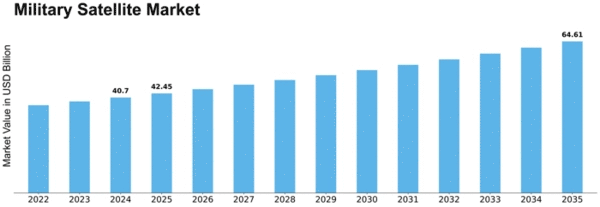

The future of the Military Satellite Market is defined by technological innovation, strategic necessity, and evolving defense doctrines. As per (MRFR), the global market was valued at USD 40.70 billion in 2024 and is forecast to climb to USD 64.61 billion by 2035, registering a CAGR of 4.29% over the next decade. This sustained growth illustrates how military space infrastructure has moved beyond niche capabilities to become an integral component of national security strategies worldwide.

One of the most prominent trends shaping this future is the expansion of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations. Unlike traditional geostationary systems, which orbit at fixed positions relative to Earth, LEO and MEO satellites offer reduced latency, improved revisit rates, and broader coverage flexibility. These advantages make them especially suitable for real-time communication, rapid reconnaissance, and dynamic battlefield awareness — all vital for modern military operations.

Miniaturization and small satellite proliferation are also defining the next wave of market expansion. Smaller, more cost-effective satellites can be deployed in large constellations, providing redundancy and resilience that traditional large satellites cannot match. This architectural shift reduces the risk associated with single-point failures and enables more agile deployments, allowing militaries to quickly scale capacities in response to emerging threats.

Artificial Intelligence (AI) and advanced onboard processing are further transforming satellite functionality. AI-enhanced systems can autonomously process imagery data, identify anomalies, and optimize mission operations with minimal ground intervention. This autonomy not only speeds decision-making but also reduces operational costs and enhances mission success probabilities — especially in contested or denied environments where communication with ground control may be disrupted.

Secure communication networks remain a core growth area. As military operations become more digitized — incorporating drones, ground vehicles, and IoT devices — the volume and sensitivity of communication traffic increase. Military satellites provide encrypted, resilient networks that enable secure data exchange across all domains, bolstering defense readiness. This is particularly crucial in hybrid warfare contexts where communication networks may be targets for cyberattacks.

Public-private partnerships will continue to be a strategic force multiplier. Nations are increasingly collaborating with commercial satellite firms to leverage cutting-edge technologies while spreading development costs. Such partnerships accelerate innovation cycles and facilitate dual-use platforms that serve both defense and civil applications without compromising security.

Regionally, the Military Satellite Market growth is influenced by shifting geopolitical dynamics. North America is expected to maintain leadership due to sustained defense budgets and robust space infrastructure. Europe is expanding its military satellite capabilities through cooperative space programs and alliance frameworks, enhancing collective security postures. Asia Pacific and Middle East & Africa are emerging as significant growth zones, with countries investing in sovereign satellite assets to bolster national defense and technological autonomy.

Emerging geopolitical tensions and increased defense spending — underscored by recent global military expenditure surges — further highlight the strategic importance of space infrastructure. Satellites augment terrestrial defense systems by providing strategic depth, real-time intelligence, and secure communication networks across diverse operational theaters, from urban environments to remote regions.

Moreover, the convergence of space technologies with terrestrial networks, including integration with 5G and beyond, opens opportunities for more resilient and expansive military communication architectures. As satellites become part of integrated defense ecosystems, their ability to support cross-domain operations — from cyber to land and air — will become increasingly valuable.

Nevertheless, challenges such as orbital congestion, space debris, and cyber vulnerabilities must be addressed through regulatory frameworks and resilient design practices. As nations invest in sustainable space operations and enhanced cybersecurity measures, the military satellite landscape will continue to mature.

In conclusion, the Military Satellite Market stands at a pivotal juncture. With steady growth forecast to 2035, fueled by technological innovation, strategic relevance, and expanding global defense efforts, satellites will remain key enablers of modern military capabilities — ensuring situational advantage and operational resilience for years to come

Related Report: