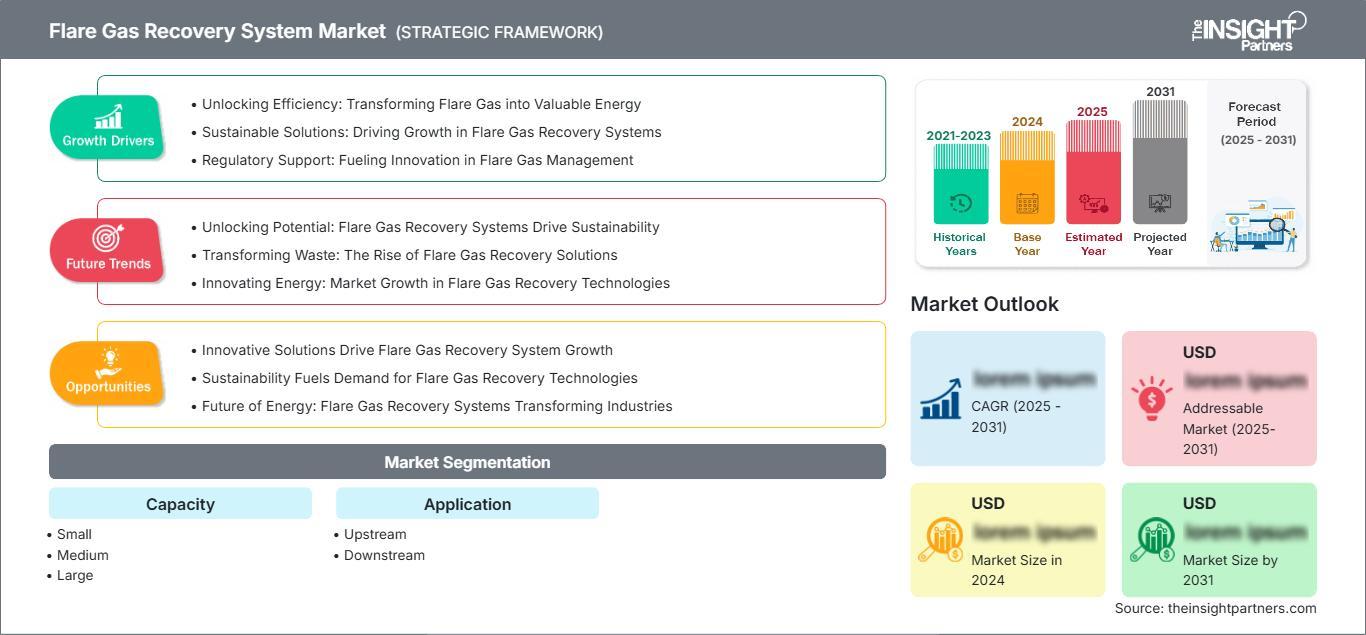

The Flare Gas Recovery System Market is gaining strong momentum as oil and gas operators, refiners, and petrochemical companies move rapidly to curb routine flaring, reduce emissions, and convert previously wasted gas into valuable energy and revenue streams. Supported by stringent global regulations, net-zero commitments, and growing economic incentives, flare gas recovery solutions are transitioning from compliance-driven investments to core strategic assets across upstream, midstream, and downstream operations.

Rising focus on decarbonization

Governments and regulators worldwide are tightening rules around methane and associated gas flaring, compelling operators to install flare gas recovery systems to maintain permits and avoid penalties. Environmental agencies in key producing regions, including North America, Europe, the Middle East, and Asia-Pacific, are increasingly linking flaring limits to climate targets and air quality objectives.

- National frameworks are mandating flare reduction plans, continuous monitoring, and reporting of flaring volumes.

- Oil and gas companies are aligning flare gas recovery projects with corporate ESG goals, sustainability disclosures, and investor expectations.

Download Sample PDF - https://www.theinsightpartners.com/sample/TIPRE00021127

Beyond emissions control, flare gas recovery directly supports national decarbonization agendas by cutting greenhouse gases while enhancing energy efficiency in refineries, LNG terminals, petrochemical complexes, and onshore and offshore production facilities.

From waste gas to revenue stream

One of the strongest market drivers is the shift from seeing flare gas as waste to treating it as a monetizable resource that can be captured, processed, and re-injected or used as fuel. Modern systems compress and condition flare gas for use in power generation, refinery fuel gas networks, gas lifting, or as feedstock for downstream products.

- Operators are increasingly using recovered gas to generate onsite electricity and steam, reducing dependence on imported fuels.

- Projects are being structured around value creation via LPG, NGLs, blue hydrogen, and carbon credit monetization schemes.

This value-centric approach shortens payback periods and improves project internal rates of return, making flare gas recovery systems attractive even in price-sensitive markets and volatile oil price environments.

Key technologies and system configurations

Flare gas recovery solutions typically combine compression, separation, and control technologies configured to match gas composition, pressure, and flow variability at each site. Reciprocating or screw compressors, liquid ring compressors, ejector-based units, and hybrid systems are deployed alongside knock-out drums, coolers, control valves, and safety systems.

- Compression-based systems are widely used for medium to high-volume applications and are favored for their reliability and scalability.

- Ejector and hybrid configurations are gaining traction where operators seek lower maintenance, compact footprints, and flexibility to handle fluctuating flare loads.

- Digital monitoring and automated controls ensure safe operation, maintain backpressure at flare headers, and optimize recovery rates in real time.

Vendors increasingly bundle engineering, procurement, installation, and long-term service agreements to reduce project complexity and lifecycle costs for end users.

Regional outlook and adoption hotspots

North America remains one of the most mature and prominent markets, driven by regulatory scrutiny, extensive shale activities, and strong corporate sustainability initiatives. State-level rules and federal methane regimes are pushing operators in key basins to implement flare gas recovery projects as part of broader emissions-reduction programs.

- In the Middle East and parts of Africa, national oil companies are prioritizing flare reduction to enhance gas availability for domestic power generation and industrial use.

- Asia-Pacific is emerging as a high-growth region, supported by LNG export capacity expansions, industrialization, and tightening environmental standards.

- Countries focused on energy security and cleaner fuels are encouraging recovery projects in refineries, petrochemical hubs, and gas processing plants.

These dynamics are creating a robust project pipeline across both brownfield upgrades and greenfield developments, spanning onshore fields, offshore platforms, and integrated refining and petrochemical complexes.

Trending keywords –

Gas Turbine Market - Insights & Forecast 2024-2031

Rare Gases Market - Size, Segments, and Growth by Forecast by 2031

Industrial Gases For Glass Industry Market - Growth and Forecast by 2031

Competitive landscape and strategic initiatives

The competitive landscape is moderately consolidated, with a mix of global technology providers and regional specialists offering integrated flare gas recovery solutions, packages, and services. Leading players include Zeeco, John Zink Hamworthy, Honeywell International, Wärtsilä, Gardner Denver, MAN Energy Solutions, SoEnergy, Transvac Systems, Aerzen, and others with strong footprints in oil and gas and process industries.

- Key companies are investing in modular, skid-mounted systems that can be rapidly deployed and scaled across multiple sites.

- Partnerships between technology providers, EPC contractors, and national oil companies are common, especially in large integrated projects.

- Vendors are enhancing their offerings with digital twins, predictive maintenance, and remote monitoring to improve uptime and performance guarantees.

Strategic focus is shifting towards lifecycle value, where suppliers support feasibility studies, design optimization, commissioning, and long-term operation to maximize the economic and environmental benefits of flare gas recovery.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Also Available in : Korean|German|Japanese|French|Chinese|Italian|Spanish