High-end fashion is entering a more discerning growth cycle in which brand equity, pricing discipline, and clienteling excellence outweigh pure network expansion. Revenue trajectories remain positive, but elevated interest rates, uneven consumer confidence, and political risk are introducing volatility into quarterly performance, particularly for logo-forward discretionary purchases. Resilience is strongest among ultra-high-net-worth clientele, while aspirational segments are trading down in frequency but not necessarily abandoning luxury, instead reallocating towards fewer, higher-value items.

Within this context, the Luxury Fashion Market is seeing a rebalancing of channel strategy. Wholesale rationalization and tighter control of off-price channels are helping protect brand positioning and margins, even as digital-native players push for broader accessibility. Flagship stores in key global cities remain strategic theaters for storytelling, craftsmanship visibility, and VIP engagement, supported by travel retail nodes in airports and resort destinations.

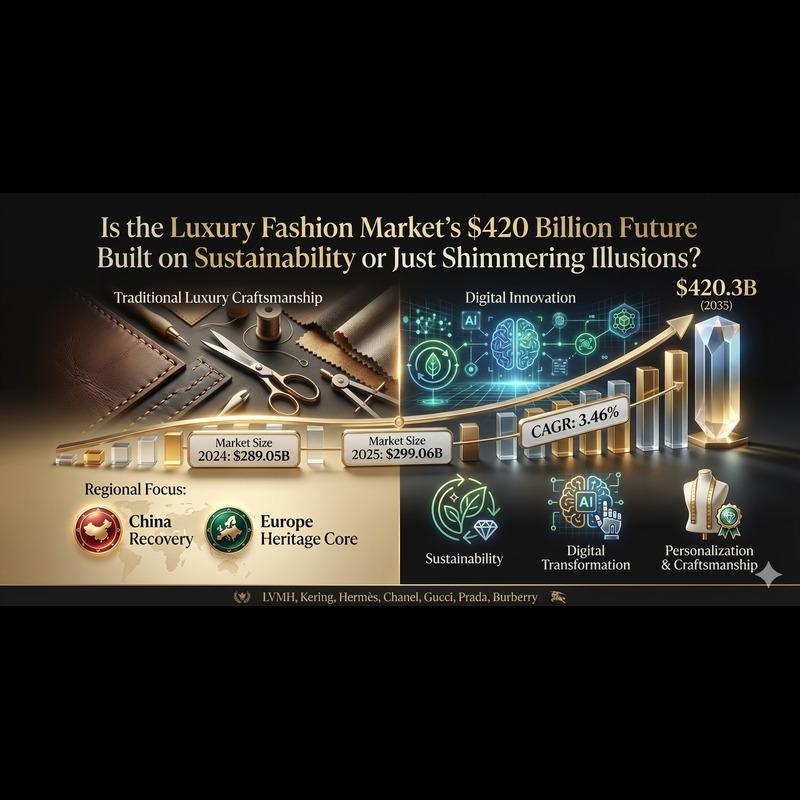

Against this backdrop, luxury fashion market trends are shaped by three structural forces: demographic rotation, sustainability, and technology. Younger consumers in Asia, Europe, and the US are blending streetwear codes with heritage houses, driving collaborations and capsule collections that bridge communities. Sustainability expectations are accelerating adoption of recycled fibers, bio-based materials, and transparency labels that document environmental and social impact.

AI is redefining how brands sense, plan, and serve demand. Generative and predictive models synthesize signals from social media, search behavior, and sell-out data to identify emergent aesthetics and optimize assortment depth by region and store. Clienteling platforms enhanced with AI help sales advisors prioritize outreach, propose look-building options, and time offers around life events, improving conversion and cross-category penetration. In supply chains, AI-powered planning tools are reducing lead times and enabling more frequent but smaller, data-driven drops to manage fashion risk.

FAQs

Q1: Why are brands reducing exposure to wholesale in the Luxury Fashion Market?

A1: Reducing wholesale dependence helps maintain pricing power, avoid over-distribution, and limit off-price leakage that can erode brand equity and long-term margin structure.

Q2: How are younger consumers influencing product development in luxury fashion?

A2: Younger buyers favor collaborations, culturally relevant storytelling, and casualized silhouettes, prompting brands to experiment with new aesthetics while preserving craftsmanship and heritage codes.

Table of Contents

1. Executive Summary

2. Market Introduction

3. Market Dynamics

4. Market Segmentation

5. Regional Analysis

6. Competitive Landscape

7. Future Outlook

8. Conclusion

9. Appendix

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact Us:

Market Research Future (part of Wantstats Research and Media Private Limited),

99 Hudson Street,5Th Floor, New York, New York 10013, United States of America

Contact Number:

+1 (855) 661-4441 (US)

+44 1720 412 167 (UK)

+91 2269738890 (APAC)

Email: [email protected]