On the basis of usability, the market is segmented into reusable and disposable rigid endoscopes. Reusable endoscopes dominate this segment due to their cost-effectiveness in settings where high procedural volumes are common. Hospitals and surgical centers prefer reusable devices because they offer long-term economic benefits, can be sterilized and maintained for repeated use, and are typically more durable. While disposable endoscopes offer the advantage of convenience and infection control, their high per-use cost and environmental concerns limit widespread adoption in most healthcare facilities. However, in certain scenarios such as emergency procedures or remote locations with limited sterilization facilities, disposable endoscopes serve as a practical solution.

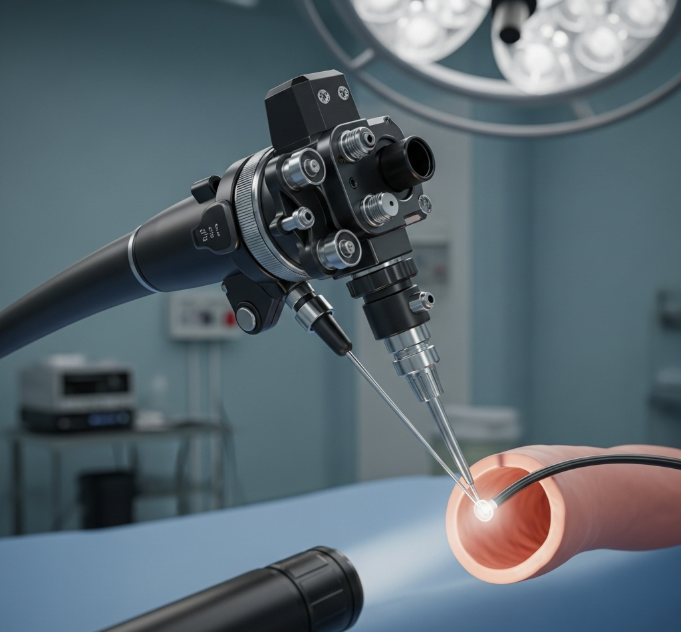

The Rigid Endoscopes Market is experiencing significant growth driven by advancements in minimally invasive surgical techniques and rising demand for precision diagnostics. These devices are essential tools in various medical disciplines such as gastroenterology, gynecology, urology, orthopedics, and general surgery. Unlike flexible endoscopes, rigid endoscopes provide high-definition images and enhanced visualization, making them indispensable in complex procedures.

📚 Full Report Link @ https://www.businessmarketinsights.com/reports/rigid-endoscopes-market

Technological innovations have played a vital role in propelling the Rigid Endoscopes Market forward. High-resolution imaging, better light transmission systems, and compatibility with digital video recording have enhanced surgical efficiency and patient outcomes. As hospitals and surgical centers increasingly adopt minimally invasive procedures, the demand for rigid endoscopes continues to surge, particularly in developed and emerging economies.

📚Download Sample PDF Copy @ https://www.businessmarketinsights.com/sample/BMIPUB00031680

Another factor contributing to the expansion of the Rigid Endoscopes Market is the growing prevalence of chronic diseases, especially cancers and gastrointestinal disorders. Early diagnosis and surgical intervention often require the use of rigid endoscopes for tissue examination and biopsy. As awareness of early disease detection grows, healthcare providers are investing in modern endoscopic equipment, thus boosting market growth.

Moreover, the aging global population is fueling demand in the Rigid Endoscopes Market. With a higher number of elderly patients requiring diagnostic and therapeutic procedures, the need for reliable and efficient endoscopic tools is on the rise. The geriatric demographic is more prone to chronic illnesses that necessitate surgical interventions, further reinforcing the importance of rigid endoscopes in modern medicine.

From a regional perspective, North America and Europe currently dominate the Rigid Endoscopes Market due to their advanced healthcare infrastructure and increased healthcare spending. However, the Asia Pacific region is projected to witness the fastest growth rate in the coming years. This is attributed to improving healthcare facilities, rising medical tourism, and increased government investment in public health infrastructure.

Hospitals are the primary end users in the Rigid Endoscopes Market, followed by ambulatory surgical centers and specialty clinics. These facilities require durable, high-performance instruments that support various surgical needs. As patient volumes grow and procedures become more technologically sophisticated, the demand for innovative rigid endoscopes remains strong.

In addition to healthcare institutions, medical device manufacturers are also contributing to the evolution of the Rigid Endoscopes Market. By investing in R\&D and collaborating with clinical experts, companies are developing compact, ergonomically designed, and multifunctional endoscopes. These advancements help reduce procedural time and improve surgical precision, aligning with the global trend toward value-based healthcare.

The COVID-19 pandemic temporarily slowed the Rigid Endoscopes Market due to the postponement of elective surgeries. However, the market rebounded as surgical volumes normalized and hospitals resumed full-scale operations. The post-pandemic period has seen renewed focus on upgrading endoscopic technologies to prepare for future healthcare demands.

In conclusion, the Rigid Endoscopes Market is poised for sustained growth, fueled by advancements in medical imaging, increased disease burden, and rising preference for minimally invasive surgeries. As healthcare systems evolve, the role of rigid endoscopes in enhancing diagnostic accuracy and surgical outcomes will continue to expand. Stakeholders in the Rigid Endoscopes Market must focus on innovation, accessibility, and clinical integration to capitalize on this growth trajectory and address future healthcare challenges effectively.

The rigid endoscopes market size is expected to reach US$ 8,829.74 million by 2031 from US$ 5,696.05 million in 2024. The market is estimated to record a CAGR of 6.5% from 2025 to 2031.

Executive Summary and Global Market Analysis:

The rigid endoscopes market is growing due to rising demand for minimally invasive surgery. Rigid endoscopes are used in various surgical procedures such as laparoscopy, arthroscopy, urology, gynecology, and ear, nose, and throat (ENT) surgery. Rigid endoscopes with quality cameras and lighting can provide physicians with the clearest and most detailed images possible, improving their ability to perform operations with precision and detail. Patients can expect to benefit from faster recovery time after surgeries, shorter stays in the hospital, and reduced risks of complications. Technological advancement in rigid endoscopes including the latest high-definition (HD) options along with lighting advancements have made rigid endoscopes more effective and easier to use. In addition, with the rising number of surgeries performed, rising elderly population, and a growing awareness of minimally invasive treatment options are driving he growth of the rigid endoscope market.

In line with the adoption rate, the global rigid endoscopes market stood at US$ 5,696.05 million in 2024 and is expected to reach US$ 8,829.74 million by 2031. Rising healthcare infrastructure and investments on medical devices in emerging country is also supporting the growth curve. The costs of endoscopes and the need for healthcare professionals with the right skills, presents a challenge for the growth of the rigid endoscopes market. Despite the challenges, the rigid endoscopes market continues to be well positioned for growth.

Rigid Endoscopes Market Drivers and Opportunities:

High Precision in Orthopedic, and Laparoscopic Procedures

Rigid endoscopes are popular instruments used in orthopedic, ENT (ear, nose, and throat), and laparoscopic surgeries involving the lower abdomen. These rigid devices provide better image stability and much more precision than flexible endoscopes. Rigid endoscopes find importance in orthopedic surgery, especially the arthroscopy procedure. During arthroscopy, the endoscope provides surgeons a preferred view of the joint under surgery, eliminating distortion for accurate diagnosis and treatment, especially with problems such as torn ligaments and damaged cartilage. Rigid endoscopes are used in ENT surgeries, especially sinus and middle ear cases, where surgeons have very limited space to establish any type of a stable view with minimal distortion. Rigid endoscopes also have a role in laparoscopic surgery, where the lower abdomen is accessed with a rigid scope providing steady views of abdominal organs. There is greater accuracy and control provided by rigid scopes over flexible scopes, which are limited in their scope of flexibility. The precision offered by rigid endoscopes minimizes the occurrence of surgical complications, improves patient outcomes, and helps to accelerate the trend toward minimally invasive surgery in orthopedic, ENT, and laparoscopic procedures.

About Us-

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.